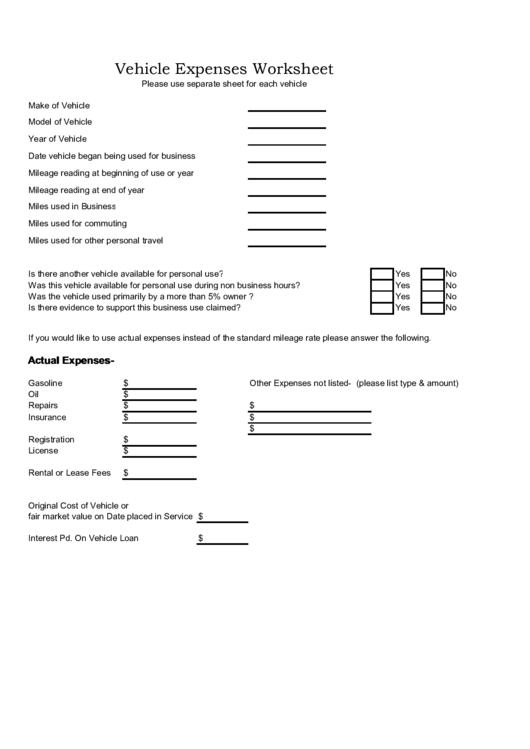

Vehicle Expenses Worksheet

Vehicle Expenses Worksheet - The purpose of this worksheet is to help you organize your tax deductible business expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction. Download or submit this worksheet to provide your vehicle expenses and mileage information for. Auto expense worksheet fill out for both mileage & actual expense methods vehicle. The purpose of this worksheet is to help you organize your tax deductible business expenses.

Download or submit this worksheet to provide your vehicle expenses and mileage information for. The purpose of this worksheet is to help you organize your tax deductible business expenses. Auto expense worksheet fill out for both mileage & actual expense methods vehicle. The purpose of this worksheet is to help you organize your tax deductible business expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction.

Download or submit this worksheet to provide your vehicle expenses and mileage information for. The purpose of this worksheet is to help you organize your tax deductible business expenses. The purpose of this worksheet is to help you organize your tax deductible business expenses. Auto expense worksheet fill out for both mileage & actual expense methods vehicle. * please note the irs requires mileage logs to be maintained to substantiate a business deduction.

Vehicle Expenses Worksheet printable pdf download

Auto expense worksheet fill out for both mileage & actual expense methods vehicle. Download or submit this worksheet to provide your vehicle expenses and mileage information for. The purpose of this worksheet is to help you organize your tax deductible business expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction. The purpose.

Tax Expenses Worksheet For Vehicle Expenses

The purpose of this worksheet is to help you organize your tax deductible business expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction. Auto expense worksheet fill out for both mileage & actual expense methods vehicle. The purpose of this worksheet is to help you organize your tax deductible business expenses. Download.

Car Expenses Excel Spreadsheet Google Spreadshee car expenses excel

Auto expense worksheet fill out for both mileage & actual expense methods vehicle. The purpose of this worksheet is to help you organize your tax deductible business expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction. The purpose of this worksheet is to help you organize your tax deductible business expenses. Download.

Car Expenses Excel Spreadsheet Google Spreadshee car expenses excel

* please note the irs requires mileage logs to be maintained to substantiate a business deduction. Auto expense worksheet fill out for both mileage & actual expense methods vehicle. The purpose of this worksheet is to help you organize your tax deductible business expenses. The purpose of this worksheet is to help you organize your tax deductible business expenses. Download.

Vehicle Expense Worksheet

* please note the irs requires mileage logs to be maintained to substantiate a business deduction. Auto expense worksheet fill out for both mileage & actual expense methods vehicle. The purpose of this worksheet is to help you organize your tax deductible business expenses. The purpose of this worksheet is to help you organize your tax deductible business expenses. Download.

20++ Car And Truck Expenses Worksheet Worksheets Decoomo

The purpose of this worksheet is to help you organize your tax deductible business expenses. Download or submit this worksheet to provide your vehicle expenses and mileage information for. * please note the irs requires mileage logs to be maintained to substantiate a business deduction. The purpose of this worksheet is to help you organize your tax deductible business expenses..

Car Expenses Excel Spreadsheet Google Spreadshee car expenses excel

* please note the irs requires mileage logs to be maintained to substantiate a business deduction. The purpose of this worksheet is to help you organize your tax deductible business expenses. Auto expense worksheet fill out for both mileage & actual expense methods vehicle. Download or submit this worksheet to provide your vehicle expenses and mileage information for. The purpose.

Auto Expense Worksheet Vehicle Expense Spreadsheet Excel Template

Download or submit this worksheet to provide your vehicle expenses and mileage information for. The purpose of this worksheet is to help you organize your tax deductible business expenses. The purpose of this worksheet is to help you organize your tax deductible business expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction..

Car Expenses Excel Spreadsheet Google Spreadshee car expenses excel

* please note the irs requires mileage logs to be maintained to substantiate a business deduction. Auto expense worksheet fill out for both mileage & actual expense methods vehicle. The purpose of this worksheet is to help you organize your tax deductible business expenses. The purpose of this worksheet is to help you organize your tax deductible business expenses. Download.

Vehicle Expense Tracker Manage Your Car Expenses Easily

Auto expense worksheet fill out for both mileage & actual expense methods vehicle. The purpose of this worksheet is to help you organize your tax deductible business expenses. The purpose of this worksheet is to help you organize your tax deductible business expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction. Download.

The Purpose Of This Worksheet Is To Help You Organize Your Tax Deductible Business Expenses.

Download or submit this worksheet to provide your vehicle expenses and mileage information for. Auto expense worksheet fill out for both mileage & actual expense methods vehicle. The purpose of this worksheet is to help you organize your tax deductible business expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction.