Salaries And Wages Expense On Balance Sheet

Salaries And Wages Expense On Balance Sheet - Web salaries and wages of a company's employees working in nonmanufacturing functions (e.g. Web a payroll journal entry is an accounting method to control gross wages and compensation expenses. Discover best practices to manage and record your payroll! Selling, general administration, etc.) are part of the expenses reported on. These amounts affect the bottom line of your income statement, which affects the. Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during the. Web your balance sheet shows salaries, wages and expenses indirectly. Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). However, labor expenses appear on the balance sheet as well, and in three.

Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Web salaries and wages of a company's employees working in nonmanufacturing functions (e.g. Discover best practices to manage and record your payroll! Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during the. Web a payroll journal entry is an accounting method to control gross wages and compensation expenses. However, labor expenses appear on the balance sheet as well, and in three. Web your balance sheet shows salaries, wages and expenses indirectly. These amounts affect the bottom line of your income statement, which affects the. Selling, general administration, etc.) are part of the expenses reported on.

Web your balance sheet shows salaries, wages and expenses indirectly. Selling, general administration, etc.) are part of the expenses reported on. Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during the. Web salaries and wages of a company's employees working in nonmanufacturing functions (e.g. Web a payroll journal entry is an accounting method to control gross wages and compensation expenses. These amounts affect the bottom line of your income statement, which affects the. However, labor expenses appear on the balance sheet as well, and in three. Discover best practices to manage and record your payroll!

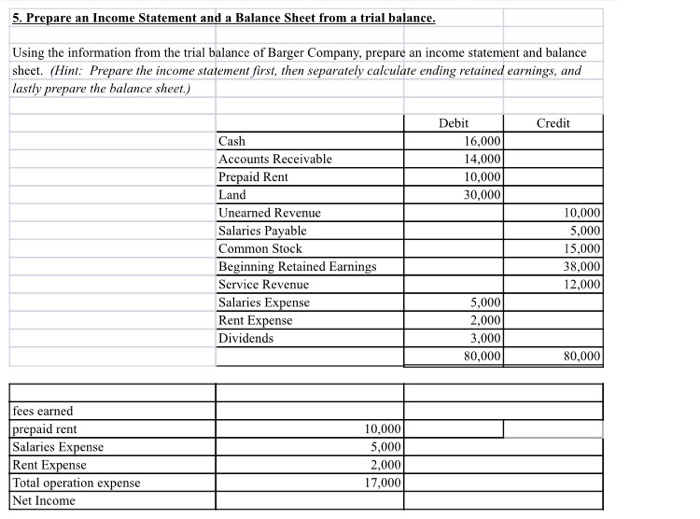

Salaries And Wages Expense Balance Sheet Financial Statement

Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Web a payroll journal entry is an accounting method to control gross wages and compensation expenses. Web your balance sheet shows salaries, wages and expenses indirectly. However, labor expenses appear on the balance sheet as well, and in three. Selling, general.

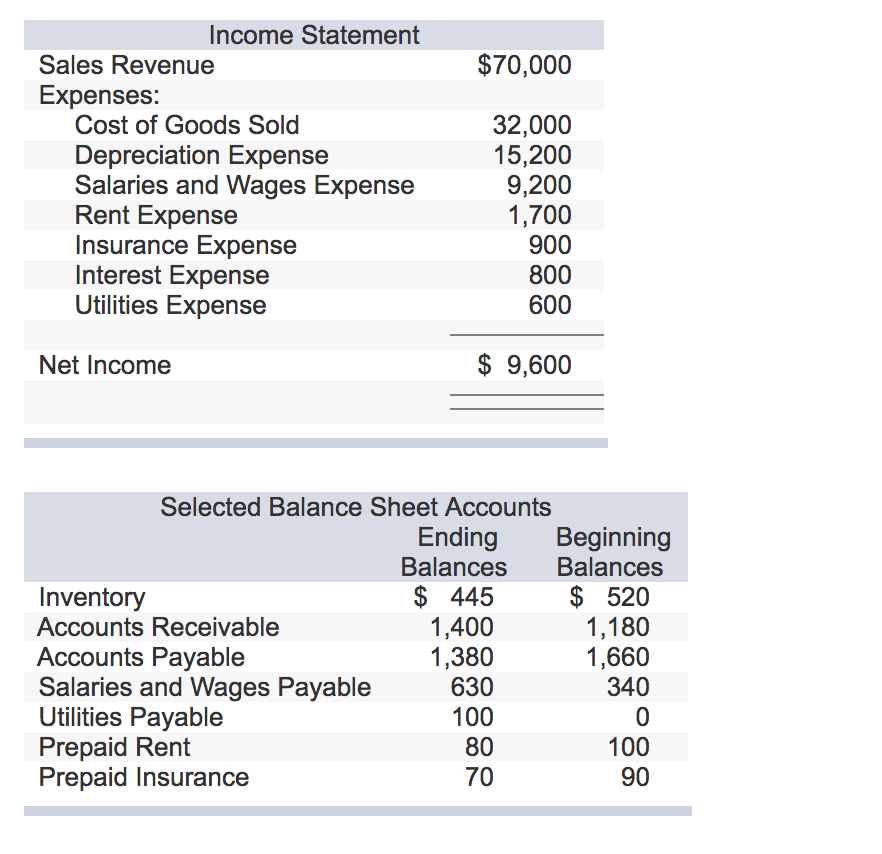

Solved The statement and selected balance sheet

Discover best practices to manage and record your payroll! Selling, general administration, etc.) are part of the expenses reported on. Web a payroll journal entry is an accounting method to control gross wages and compensation expenses. However, labor expenses appear on the balance sheet as well, and in three. Web salaries and wages of a company's employees working in nonmanufacturing.

Solved Assets Cash Office Supplies and Salaries Expense

Web salaries and wages of a company's employees working in nonmanufacturing functions (e.g. However, labor expenses appear on the balance sheet as well, and in three. These amounts affect the bottom line of your income statement, which affects the. Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record.

Solved The statement and selected balance sheet

Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Discover best practices to manage and record your payroll! Selling, general administration, etc.) are part of the expenses reported on. Web your balance sheet shows salaries, wages and expenses indirectly. Web the account wages and salaries expense (or separate accounts such.

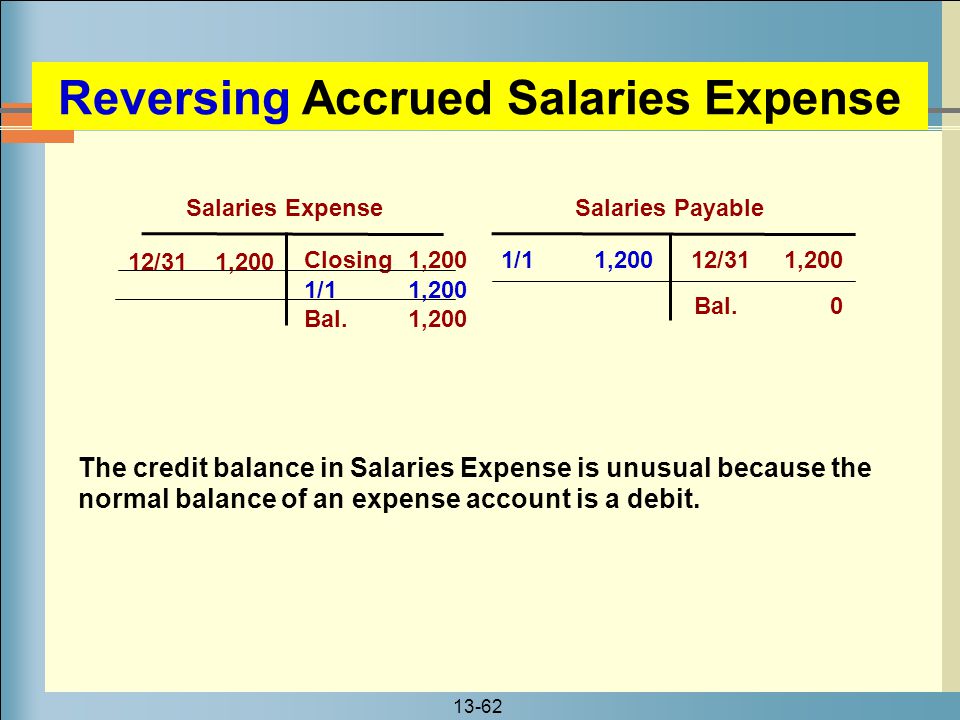

The Differences in Wages Payable & Wages Expense Business Accounting

Discover best practices to manage and record your payroll! Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Selling, general administration, etc.) are part of the expenses reported on. Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record.

Solved Selected balance sheet information and the

Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Web your balance sheet shows salaries, wages and expenses indirectly. These amounts affect the bottom line of your income statement, which affects the. Selling, general administration, etc.) are part of the expenses reported on. Web a payroll journal entry is an.

Wages Payable Current Liability Accounting

These amounts affect the bottom line of your income statement, which affects the. Discover best practices to manage and record your payroll! Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during the. Selling, general administration, etc.) are part of the expenses reported.

[Solved] statement and balance sheet excerp SolutionInn

Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). However, labor expenses appear on the balance sheet as well, and in three. Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during the..

Accrued Salaries In Balance Sheet Schedule 6 Format Pdf Financial

Web salaries and wages of a company's employees working in nonmanufacturing functions (e.g. Web a payroll journal entry is an accounting method to control gross wages and compensation expenses. However, labor expenses appear on the balance sheet as well, and in three. Web most students learn that labor and wages are a cost item on the profit and loss statement.

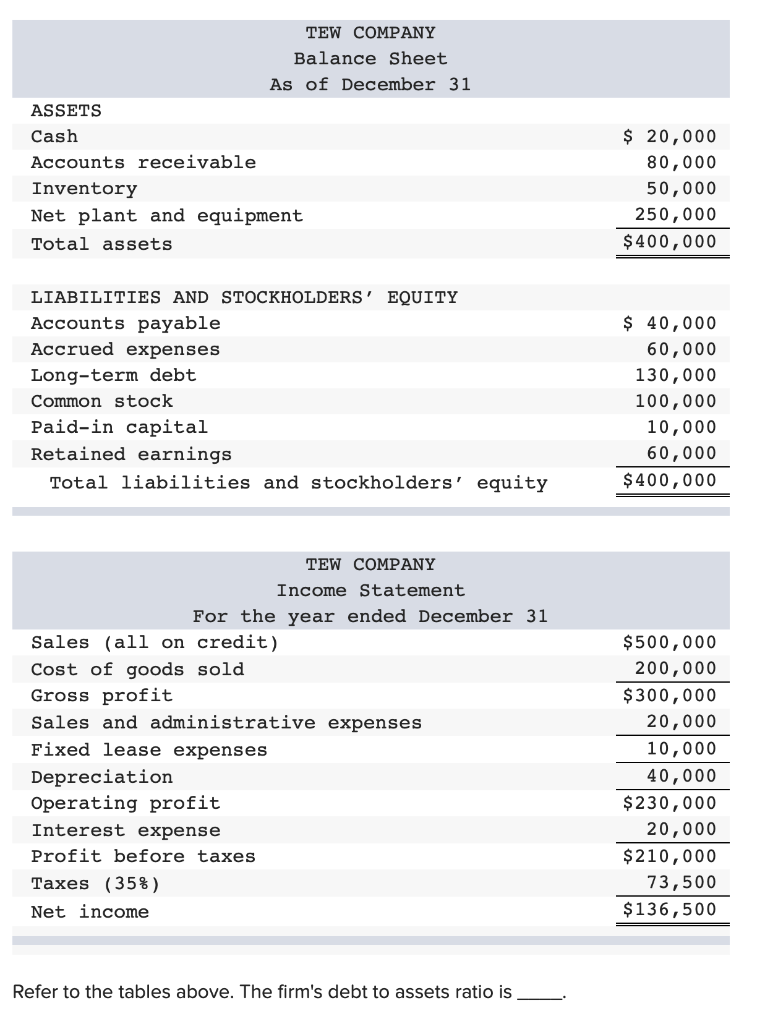

Solved TEW COMPANY Balance Sheet As of December 31 ASSETS

Web a payroll journal entry is an accounting method to control gross wages and compensation expenses. Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by.

Web Salaries And Wages Of A Company's Employees Working In Nonmanufacturing Functions (E.g.

These amounts affect the bottom line of your income statement, which affects the. Web a payroll journal entry is an accounting method to control gross wages and compensation expenses. However, labor expenses appear on the balance sheet as well, and in three. Discover best practices to manage and record your payroll!

Web The Account Wages And Salaries Expense (Or Separate Accounts Such As Wages Expense Or Salaries Expense) Are Used To Record The Amounts Earned By Employees During The.

Web your balance sheet shows salaries, wages and expenses indirectly. Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Selling, general administration, etc.) are part of the expenses reported on.

![[Solved] statement and balance sheet excerp SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1543/4/8/9/0145bffc5f6069c91543471535041.jpg)