Lease Liability On Balance Sheet

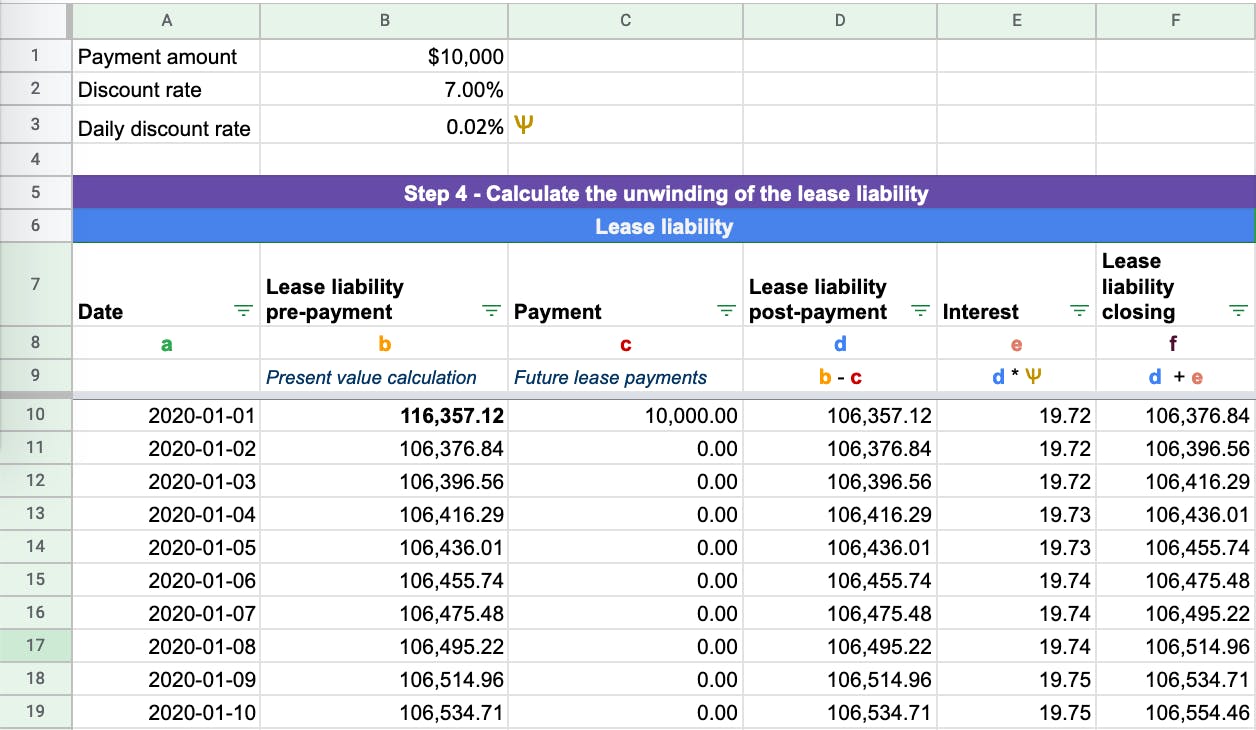

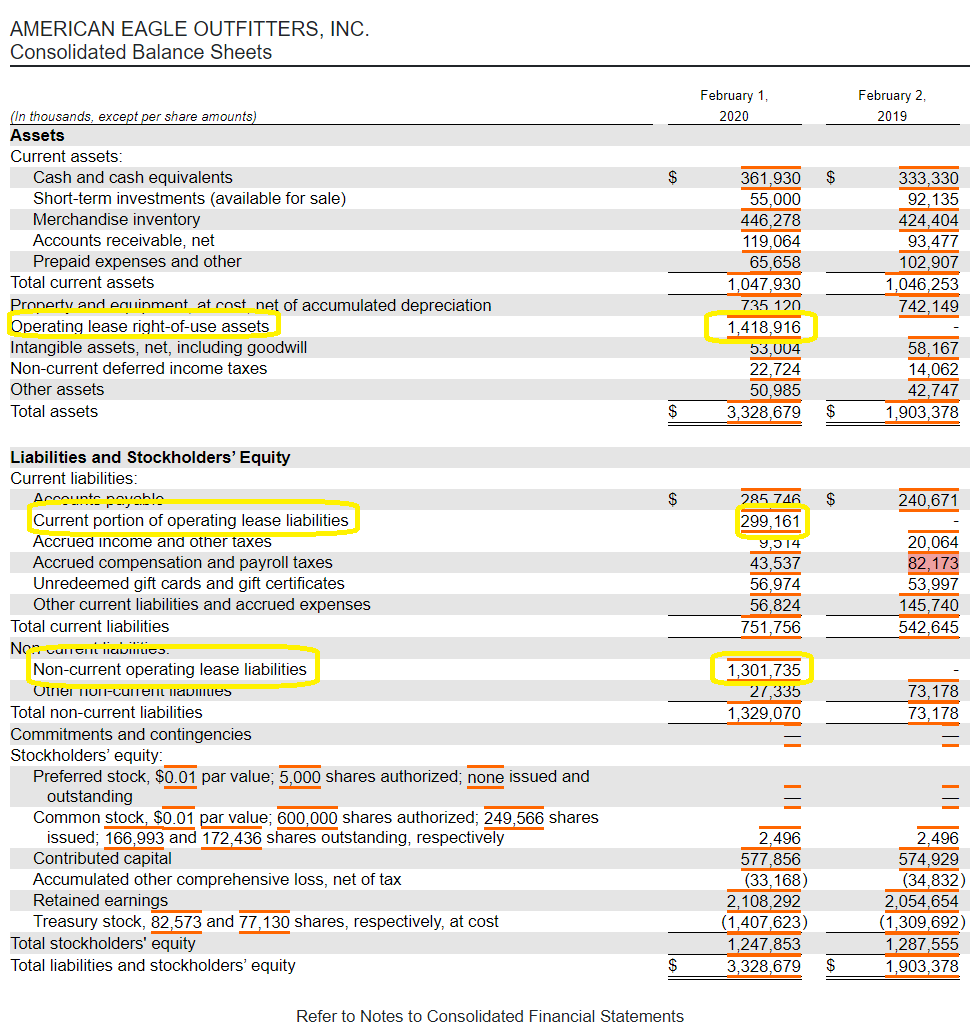

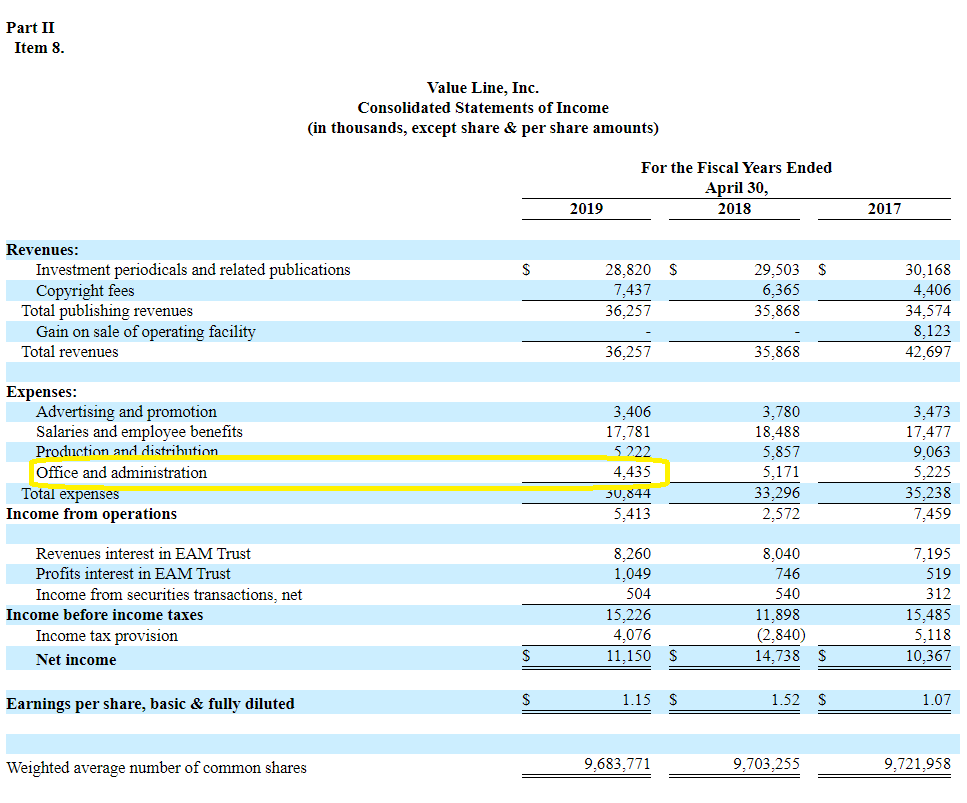

Lease Liability On Balance Sheet - Web with no difference on the p&l between calculations, we’ve made $324,000 in lease payments, yet only reduced the lease liability on the balance sheet by. Web under the new lease accounting standard ifrs 16 / aasb 16, the net present value calculation is referred to as a lease liability, and the leased asset is. They reported operating lease assets and liabilities recorded in the. Web under asc 842, regardless of the lease classification, the lease is coming on the balance sheet. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors:

Web with no difference on the p&l between calculations, we’ve made $324,000 in lease payments, yet only reduced the lease liability on the balance sheet by. Web under asc 842, regardless of the lease classification, the lease is coming on the balance sheet. Web under the new lease accounting standard ifrs 16 / aasb 16, the net present value calculation is referred to as a lease liability, and the leased asset is. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: They reported operating lease assets and liabilities recorded in the.

They reported operating lease assets and liabilities recorded in the. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: Web under the new lease accounting standard ifrs 16 / aasb 16, the net present value calculation is referred to as a lease liability, and the leased asset is. Web under asc 842, regardless of the lease classification, the lease is coming on the balance sheet. Web with no difference on the p&l between calculations, we’ve made $324,000 in lease payments, yet only reduced the lease liability on the balance sheet by.

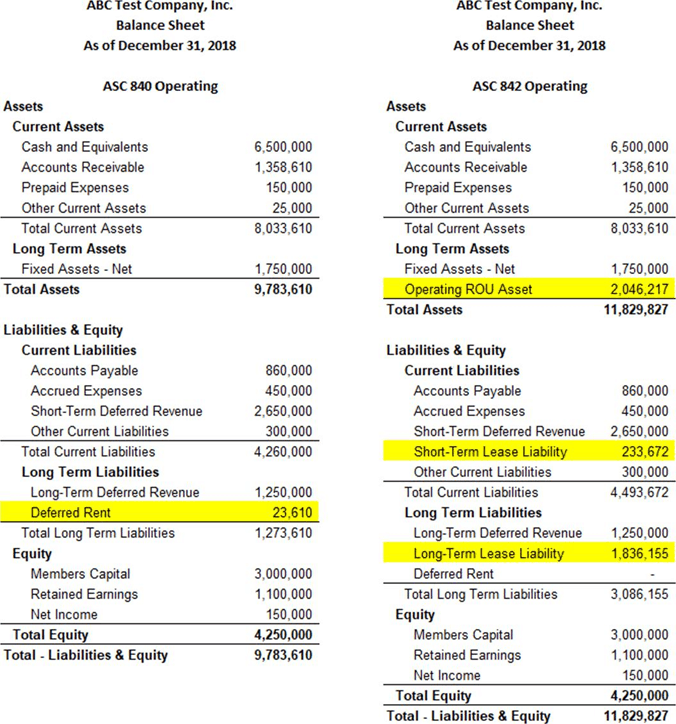

Practical Illustrations of the New Leasing Standard for Lessees The

They reported operating lease assets and liabilities recorded in the. Web with no difference on the p&l between calculations, we’ve made $324,000 in lease payments, yet only reduced the lease liability on the balance sheet by. Web under the new lease accounting standard ifrs 16 / aasb 16, the net present value calculation is referred to as a lease liability,.

ASC 842 Lease Accounting Balance Sheet Examples Visual Lease

Web with no difference on the p&l between calculations, we’ve made $324,000 in lease payments, yet only reduced the lease liability on the balance sheet by. They reported operating lease assets and liabilities recorded in the. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: Web under the new lease.

Lease Liabilities The balance sheet impact Occupier

Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: Web under asc 842, regardless of the lease classification, the lease is coming on the balance sheet. Web with no difference on the p&l between calculations, we’ve made $324,000 in lease payments, yet only reduced the lease liability on the balance.

Jack jumping formal right of use asset calculation terorist

Web under the new lease accounting standard ifrs 16 / aasb 16, the net present value calculation is referred to as a lease liability, and the leased asset is. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: Web under asc 842, regardless of the lease classification, the lease is.

Lease Liabilities The True Impact on the Balance Sheet

Web with no difference on the p&l between calculations, we’ve made $324,000 in lease payments, yet only reduced the lease liability on the balance sheet by. They reported operating lease assets and liabilities recorded in the. Web under the new lease accounting standard ifrs 16 / aasb 16, the net present value calculation is referred to as a lease liability,.

Practical Illustrations of the New Leasing Standard for Lessees The

They reported operating lease assets and liabilities recorded in the. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: Web with no difference on the p&l between calculations, we’ve made $324,000 in lease payments, yet only reduced the lease liability on the balance sheet by. Web under asc 842, regardless.

Asc 842 Lease Accounting Template

Web under the new lease accounting standard ifrs 16 / aasb 16, the net present value calculation is referred to as a lease liability, and the leased asset is. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: They reported operating lease assets and liabilities recorded in the. Web with.

Operating Leases Now in the Balance Sheet GAAP Accounting Made Simple

Web under asc 842, regardless of the lease classification, the lease is coming on the balance sheet. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: Web under the new lease accounting standard ifrs 16 / aasb 16, the net present value calculation is referred to as a lease liability,.

Balance Sheet( in thousands)(1) Includes capital lease obligations of

Web under the new lease accounting standard ifrs 16 / aasb 16, the net present value calculation is referred to as a lease liability, and the leased asset is. Web under asc 842, regardless of the lease classification, the lease is coming on the balance sheet. Web with no difference on the p&l between calculations, we’ve made $324,000 in lease.

Accounting for Operating Leases in the Balance Sheet Simply Explained

Web under asc 842, regardless of the lease classification, the lease is coming on the balance sheet. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: They reported operating lease assets and liabilities recorded in the. Web with no difference on the p&l between calculations, we’ve made $324,000 in lease.

Web With No Difference On The P&L Between Calculations, We’ve Made $324,000 In Lease Payments, Yet Only Reduced The Lease Liability On The Balance Sheet By.

Web under the new lease accounting standard ifrs 16 / aasb 16, the net present value calculation is referred to as a lease liability, and the leased asset is. They reported operating lease assets and liabilities recorded in the. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: Web under asc 842, regardless of the lease classification, the lease is coming on the balance sheet.