Is Service Revenue On A Balance Sheet

Is Service Revenue On A Balance Sheet - Service revenue appears on a balance sheet as an accounts receivable for services rendered, which are also known as accounts payable. this amount is. To summarize, service revenue is reported on an income statement and is not an asset (nor a current asset). Web for accounting purposes, revenue is recorded on the income statement rather than on a balance sheet. Web accounting for service revenue summary. Web is service revenue on a balance sheet? It goes on a separate line item that is specific to revenue, below the sales revenue line. Service revenue always goes on the. A balance sheet describes a company's assets, liabilities, and stockholders' or. Web accountants list service revenue at the top of the income statement. Accounts receivable and cash are reported.

Web is service revenue on a balance sheet? Web service revenue is the income a company generates from providing a service. Web for accounting purposes, revenue is recorded on the income statement rather than on a balance sheet. A balance sheet describes a company's assets, liabilities, and stockholders' or. Web accounting for service revenue summary. Service revenue appears on a balance sheet as an accounts receivable for services rendered, which are also known as accounts payable. this amount is. It goes on a separate line item that is specific to revenue, below the sales revenue line. Web accountants list service revenue at the top of the income statement. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a. To summarize, service revenue is reported on an income statement and is not an asset (nor a current asset).

Accounts receivable and cash are reported. A balance sheet describes a company's assets, liabilities, and stockholders' or. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a. Web is service revenue on a balance sheet? Web service revenue is the income a company generates from providing a service. Web accounting for service revenue summary. Service revenue always goes on the. It goes on a separate line item that is specific to revenue, below the sales revenue line. Web for accounting purposes, revenue is recorded on the income statement rather than on a balance sheet. Service revenue appears on a balance sheet as an accounts receivable for services rendered, which are also known as accounts payable. this amount is.

Unearned Revenue What It Is, How It Is Recorded and Reported

Service revenue appears on a balance sheet as an accounts receivable for services rendered, which are also known as accounts payable. this amount is. A balance sheet describes a company's assets, liabilities, and stockholders' or. Web for accounting purposes, revenue is recorded on the income statement rather than on a balance sheet. Web service revenue is the income a company.

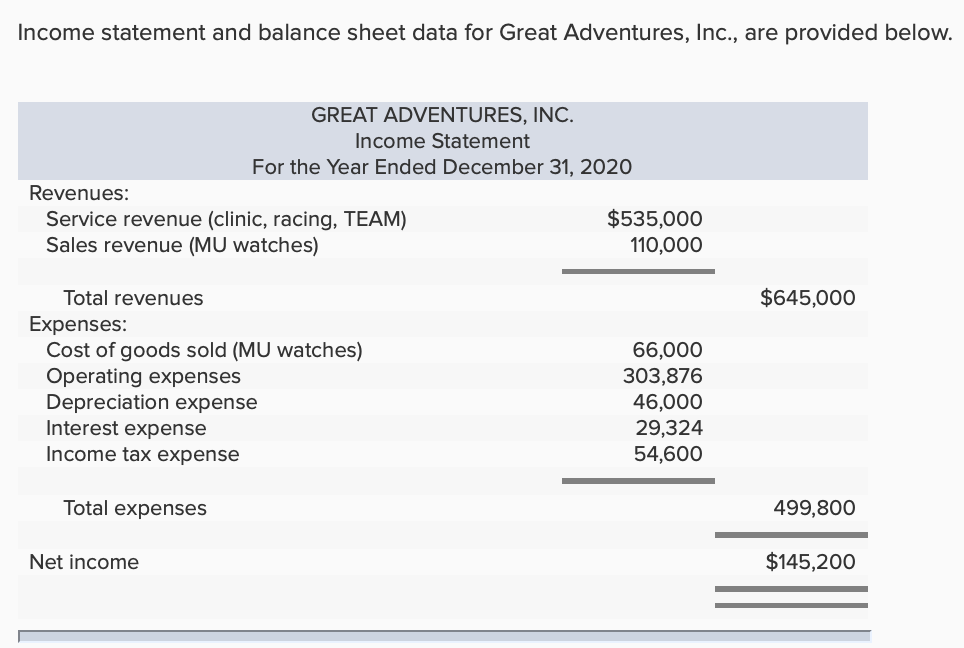

Solved statement and balance sheet data for Great

Web accountants list service revenue at the top of the income statement. Web for accounting purposes, revenue is recorded on the income statement rather than on a balance sheet. Web service revenue is the income a company generates from providing a service. To summarize, service revenue is reported on an income statement and is not an asset (nor a current.

Does Service Revenue Go On The Balance Sheet cloudshareinfo

Web is service revenue on a balance sheet? Service revenue appears on a balance sheet as an accounts receivable for services rendered, which are also known as accounts payable. this amount is. Web service revenue is the income a company generates from providing a service. To summarize, service revenue is reported on an income statement and is not an asset.

Prepare Financial Statements Using the Adjusted Trial Balance SPSCC

Web service revenue is the income a company generates from providing a service. To summarize, service revenue is reported on an income statement and is not an asset (nor a current asset). Service revenue appears on a balance sheet as an accounts receivable for services rendered, which are also known as accounts payable. this amount is. Web for accounting purposes,.

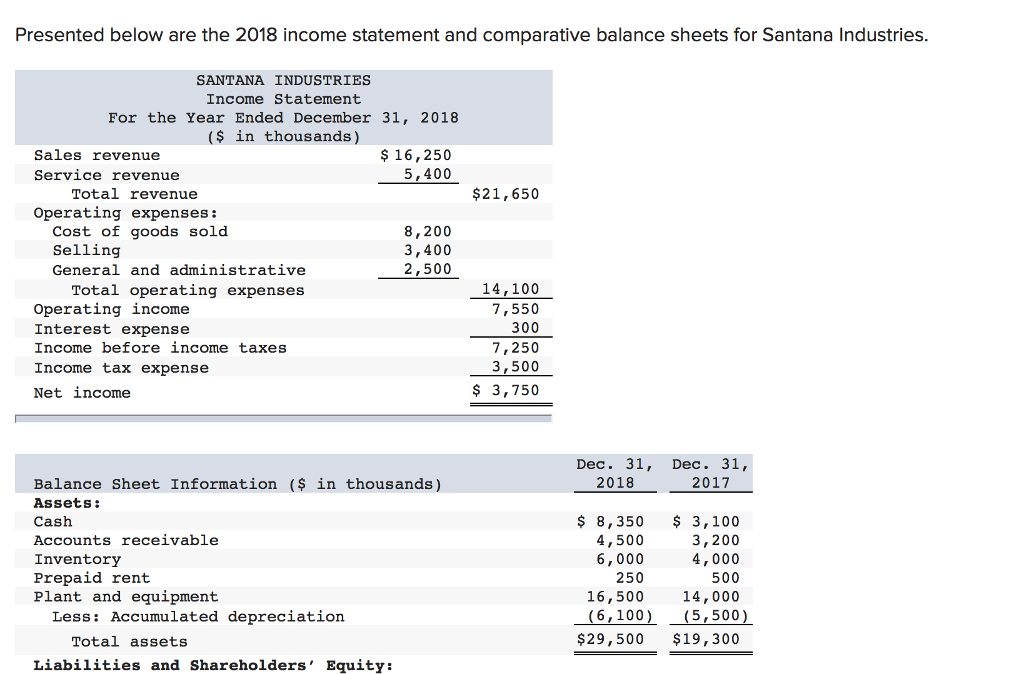

Solved Presented below are the 2018 statement and

Service revenue always goes on the. It goes on a separate line item that is specific to revenue, below the sales revenue line. Web for accounting purposes, revenue is recorded on the income statement rather than on a balance sheet. Web service revenue is the income a company generates from providing a service. Web accountants list service revenue at the.

What is Unearned Revenue? QuickBooks Canada Blog

To summarize, service revenue is reported on an income statement and is not an asset (nor a current asset). Web is service revenue on a balance sheet? Accounts receivable and cash are reported. A balance sheet describes a company's assets, liabilities, and stockholders' or. Web accountants list service revenue at the top of the income statement.

The Importance of an Accurate Balance Sheet Basis 365 Accounting

To summarize, service revenue is reported on an income statement and is not an asset (nor a current asset). A balance sheet describes a company's assets, liabilities, and stockholders' or. Accounts receivable and cash are reported. It goes on a separate line item that is specific to revenue, below the sales revenue line. Web accountants list service revenue at the.

Does Service Revenue Go On The Balance Sheet cloudshareinfo

Service revenue appears on a balance sheet as an accounts receivable for services rendered, which are also known as accounts payable. this amount is. To summarize, service revenue is reported on an income statement and is not an asset (nor a current asset). A balance sheet describes a company's assets, liabilities, and stockholders' or. Web service revenue is the income.

Service Revenue On Balance Sheet 5avedesigns

To summarize, service revenue is reported on an income statement and is not an asset (nor a current asset). Web for accounting purposes, revenue is recorded on the income statement rather than on a balance sheet. Web accountants list service revenue at the top of the income statement. Web accounting for service revenue summary. It goes on a separate line.

Does Service Revenue Go On The Balance Sheet cloudshareinfo

Accounts receivable and cash are reported. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a. It goes on a separate line item that is specific to revenue, below the sales revenue line. Web service revenue is the income a company generates from providing a service. Web.

Web For Accounting Purposes, Revenue Is Recorded On The Income Statement Rather Than On A Balance Sheet.

It goes on a separate line item that is specific to revenue, below the sales revenue line. Service revenue always goes on the. To summarize, service revenue is reported on an income statement and is not an asset (nor a current asset). Web is service revenue on a balance sheet?

The Amount Is Displayed At The Top Of An Income Statement And Is Added To The Revenue From Product Earnings To Show A.

Web service revenue is the income a company generates from providing a service. Service revenue appears on a balance sheet as an accounts receivable for services rendered, which are also known as accounts payable. this amount is. A balance sheet describes a company's assets, liabilities, and stockholders' or. Web accounting for service revenue summary.

Accounts Receivable And Cash Are Reported.

Web accountants list service revenue at the top of the income statement.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)