Irs Mandated Wisp Template For Tax Professionals

Irs Mandated Wisp Template For Tax Professionals - Web file your taxes for free. The wisp template is required for tax professionals by the irs and helps to ensure that important records are accurate and available, allowing the. Web for many tax professionals, knowing where to start when developing a wisp is difficult. Web the federal trade commission's safeguards rule requires professional tax preparers to prepare a written information security plan (wisp) describing how they protect. Web in conjunction with the security summit, irs has now released a sample security plan designed to help tax pros, especially those with smaller practices, protect their data and. Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Web we ask this question during our security training programs and find a significant number of firms currently do not have a wisp. Sign in to your account. Web our directory of federal tax return preparers with credentials and select qualifications can help you find preparers in your area who currently hold professional credentials.

All tax and accounting firms should do the following:. Web how to create a wispwritten information security plan for data safety with data security incidents continuing, tax professionals must have current written information security. | natp and data security expert brad messner discuss the irs's newly released security. Web information for tax professionals. Sign in to your account. A wisp is a written information security plan that is required for certain businesses, such as tax. Web tax preparers, protect your business with a irs wisp. The wisp template is required for tax professionals by the irs and helps to ensure that important records are accurate and available, allowing the. Web we ask this question during our security training programs and find a significant number of firms currently do not have a wisp. Web 7 months ago irs info/alerts what is a wisp and how do i create one?

Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Web the federal trade commission's safeguards rule requires professional tax preparers to prepare a written information security plan (wisp) describing how they protect. Access online tools for tax professionals, register for or renew your preparer tax identification number (ptin),. Web file your taxes for free. Web information for tax professionals. Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create. Download our free template to help you get organized and comply with wisp irs regulations. Web we ask this question during our security training programs and find a significant number of firms currently do not have a wisp. | natp and data security expert brad messner discuss the irs's newly released security. A wisp is a written information security plan that is required for certain businesses, such as tax.

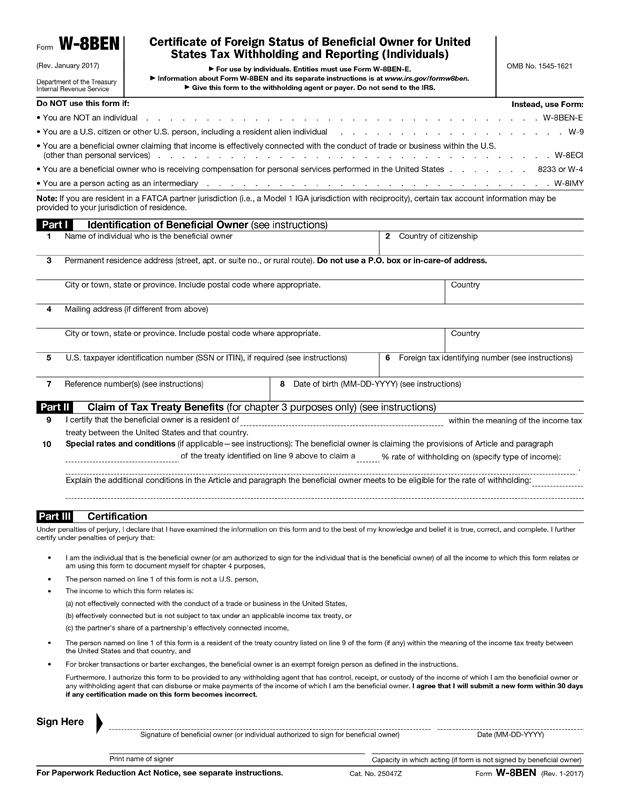

Formulario W8Ben Consejos

Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create. Web the federal trade commission's safeguards rule requires professional tax preparers to prepare a written information security plan (wisp) describing how they protect. Web our directory of federal tax return preparers with credentials and.

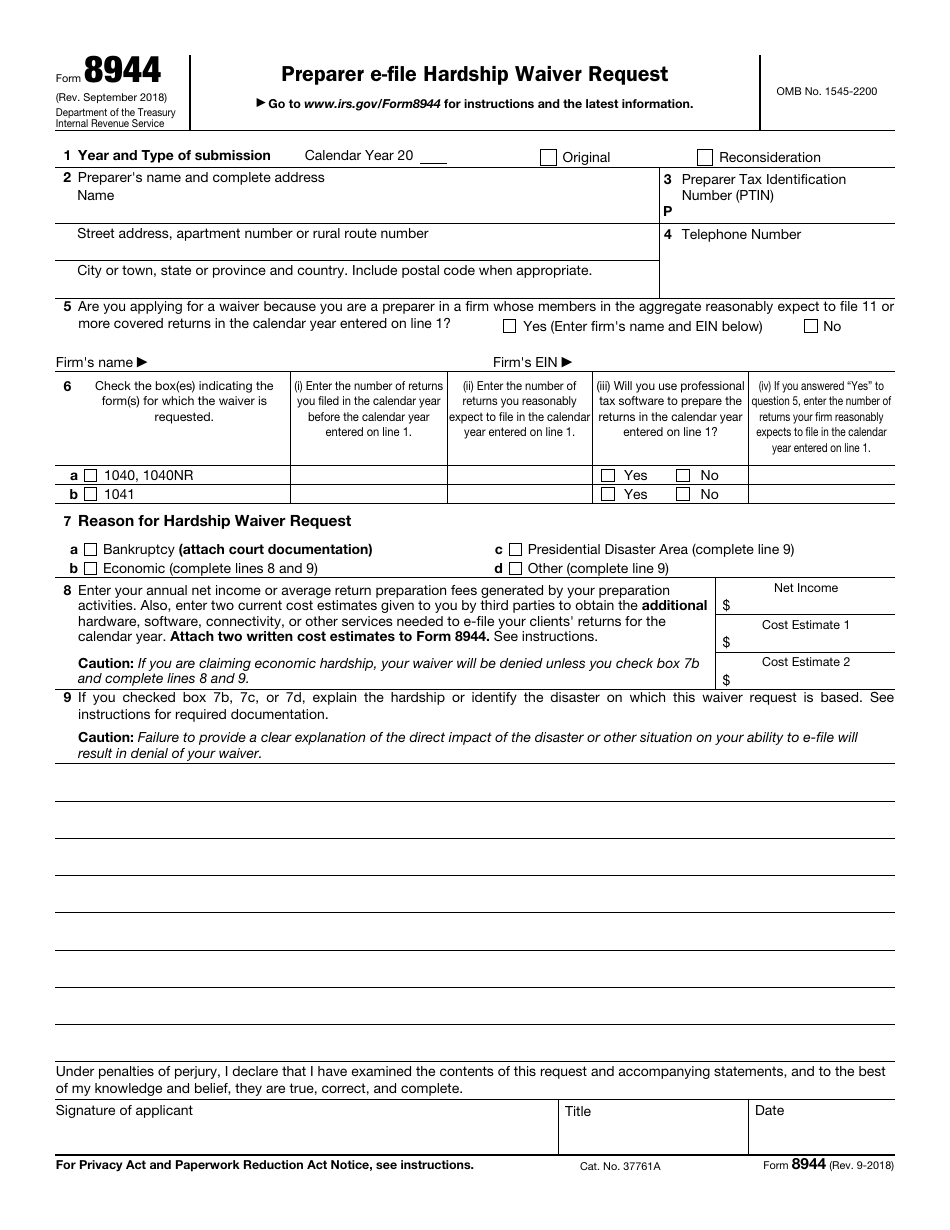

IRS Form 8944 Download Fillable PDF or Fill Online Preparer EFile

Web how to create a wispwritten information security plan for data safety with data security incidents continuing, tax professionals must have current written information security. A wisp is a written information security plan that is required for certain businesses, such as tax. | natp and data security expert brad messner discuss the irs's newly released security. Web washington — the.

Wss Security

Sign in to your account. Web in conjunction with the security summit, irs has now released a sample security plan designed to help tax pros, especially those with smaller practices, protect their data and. Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create..

IRS OUTLINES PROCEDURES FOR PAYROLL TAX CREDITS AND RAPID REFUNDS FOR

| natp and data security expert brad messner discuss the irs's newly released security. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. All tax and accounting firms should do the following:. Web we ask this question during our security training programs and find a significant number of firms currently.

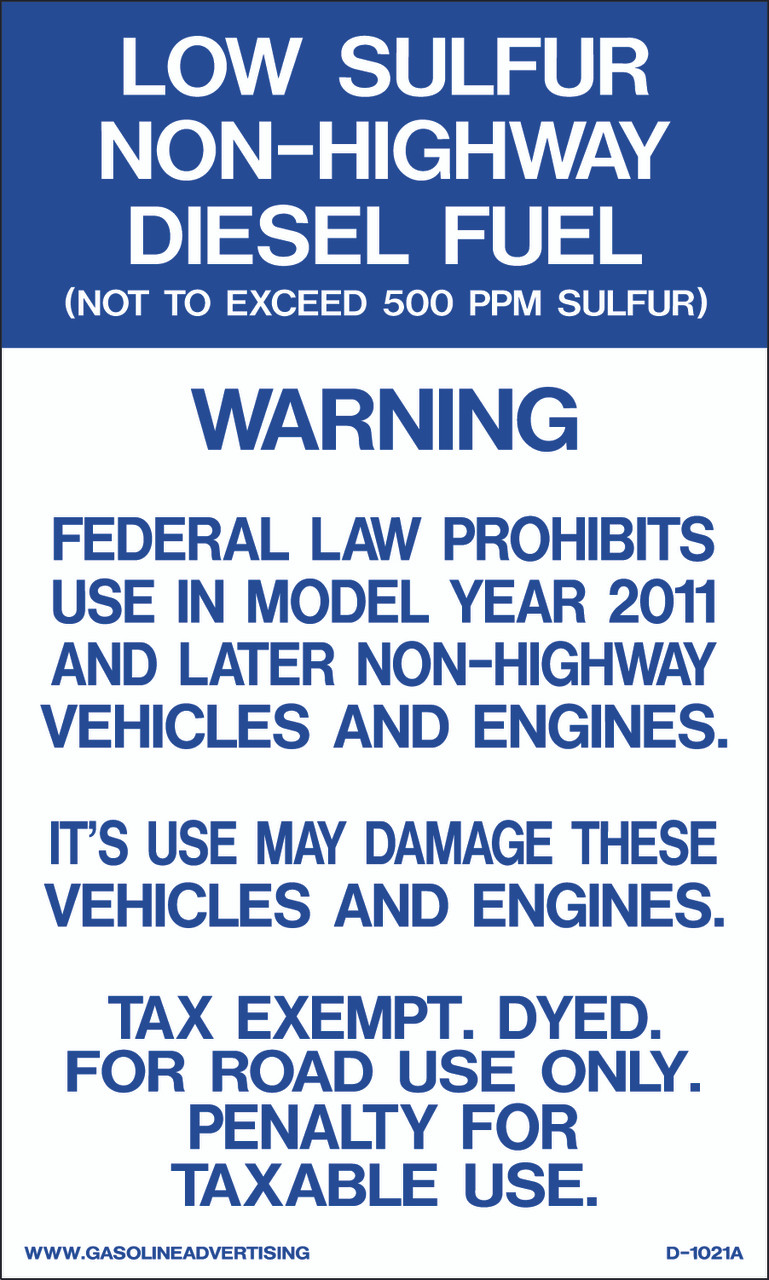

D1021A IRS Mandated Decal LOW SULFUR... Gasoline Advertising Products

Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Web information for tax professionals. Written comprehensive information security program. Access online tools for tax professionals, register for or renew your preparer tax identification number (ptin),. The wisp template is required for tax professionals by the irs and helps to ensure.

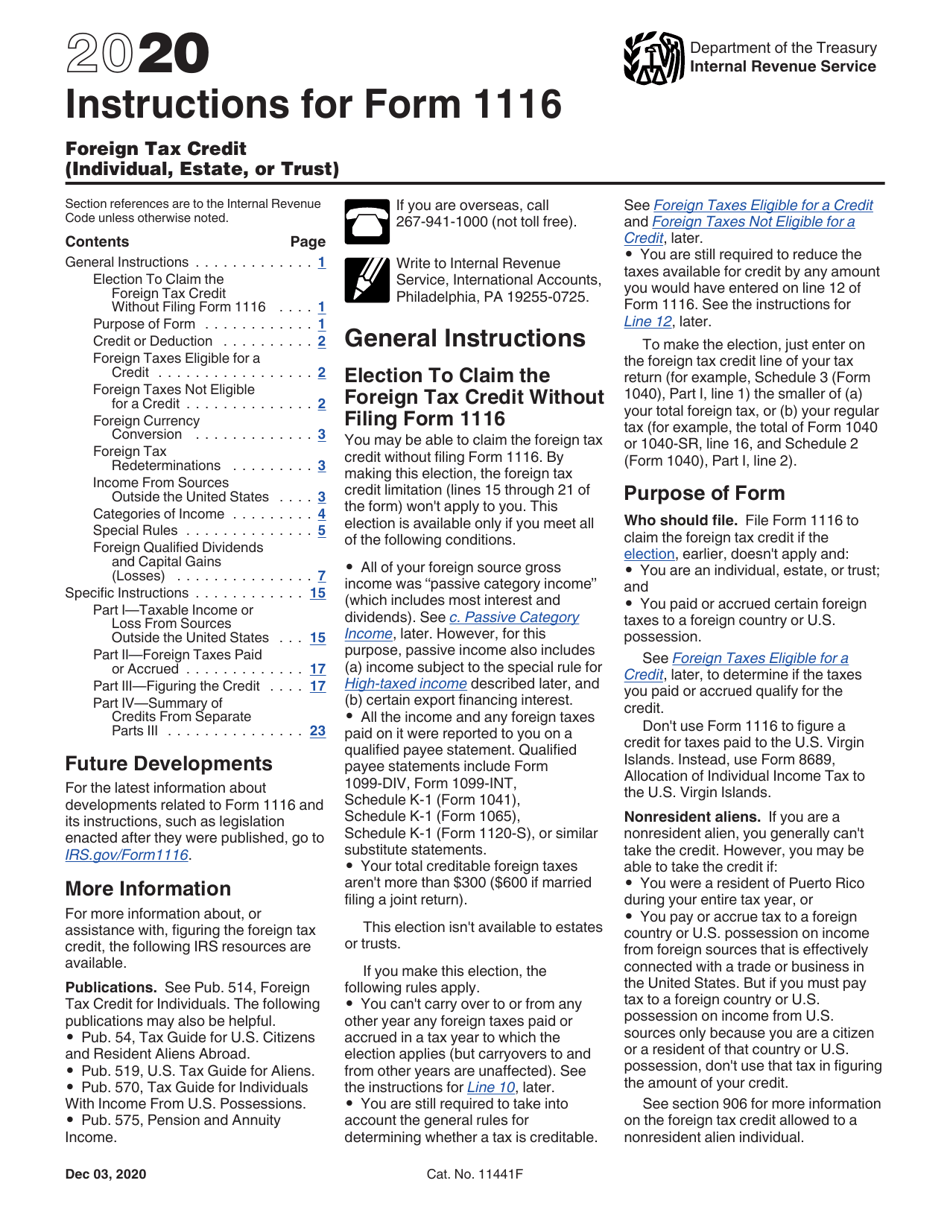

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

Download our free template to help you get organized and comply with wisp irs regulations. All tax and accounting firms should do the following:. Web the federal trade commission's safeguards rule requires professional tax preparers to prepare a written information security plan (wisp) describing how they protect. Written comprehensive information security program. The wisp template is required for tax professionals.

Written Information Security Program (WISP) Security Waypoint

A wisp is a written information security plan that is required for certain businesses, such as tax. Many say they were not aware of this requirement. Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create. Access online tools for tax professionals, register for.

New IRS Site Could Make it Easy for Thieves to Intercept Some Stimulus

Web for many tax professionals, knowing where to start when developing a wisp is difficult. Written comprehensive information security program. Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create. Web in conjunction with the security summit, irs has now released a sample security.

WISP Application Form Student Loan Irs Tax Forms

Web tax preparers, protect your business with a irs wisp. Web our directory of federal tax return preparers with credentials and select qualifications can help you find preparers in your area who currently hold professional credentials. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Web we ask this question.

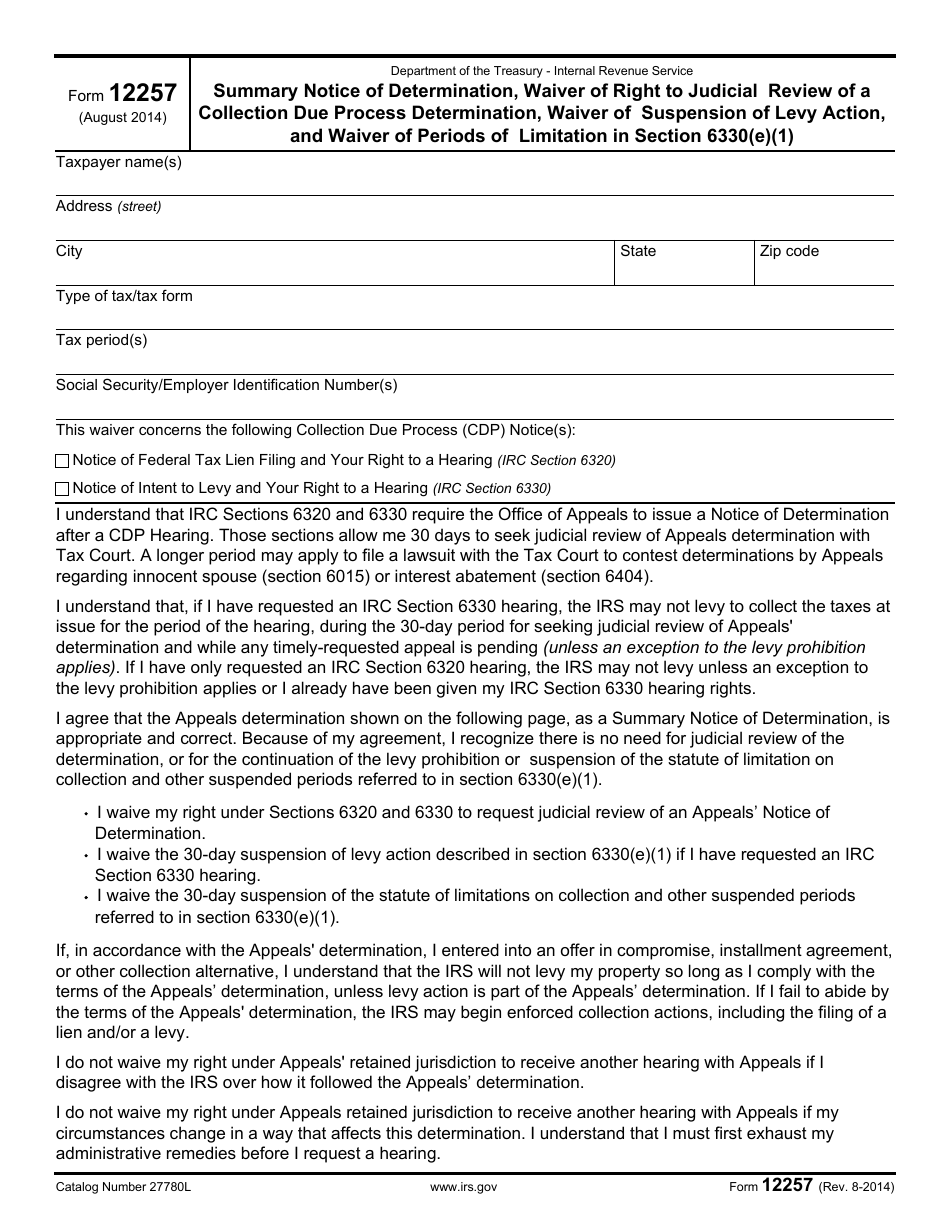

IRS Form 12257 Download Fillable PDF or Fill Online Summary Notice of

Web we ask this question during our security training programs and find a significant number of firms currently do not have a wisp. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. All tax and accounting firms should do the following:. Web for many tax professionals, knowing where to start.

Download Our Free Template To Help You Get Organized And Comply With Wisp Irs Regulations.

Web file your taxes for free. Written comprehensive information security program. Web our directory of federal tax return preparers with credentials and select qualifications can help you find preparers in your area who currently hold professional credentials. Many say they were not aware of this requirement.

Web 7 Months Ago Irs Info/Alerts What Is A Wisp And How Do I Create One?

All tax and accounting firms should do the following:. Web the federal trade commission's safeguards rule requires professional tax preparers to prepare a written information security plan (wisp) describing how they protect. Access online tools for tax professionals, register for or renew your preparer tax identification number (ptin),. Web information for tax professionals.

Web For Many Tax Professionals, Knowing Where To Start When Developing A Wisp Is Difficult.

| natp and data security expert brad messner discuss the irs's newly released security. Sign in to your account. Web we ask this question during our security training programs and find a significant number of firms currently do not have a wisp. Web tax preparers, protect your business with a irs wisp.

Web How To Create A Wispwritten Information Security Plan For Data Safety With Data Security Incidents Continuing, Tax Professionals Must Have Current Written Information Security.

Web in conjunction with the security summit, irs has now released a sample security plan designed to help tax pros, especially those with smaller practices, protect their data and. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create. The wisp template is required for tax professionals by the irs and helps to ensure that important records are accurate and available, allowing the.