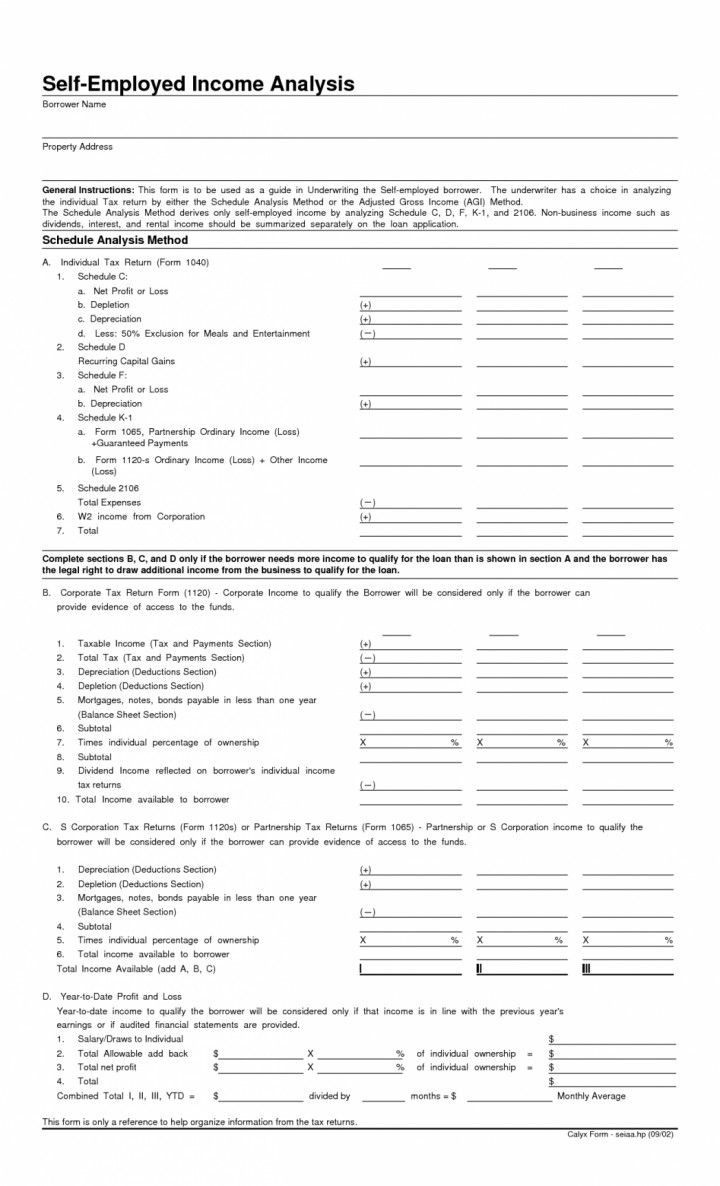

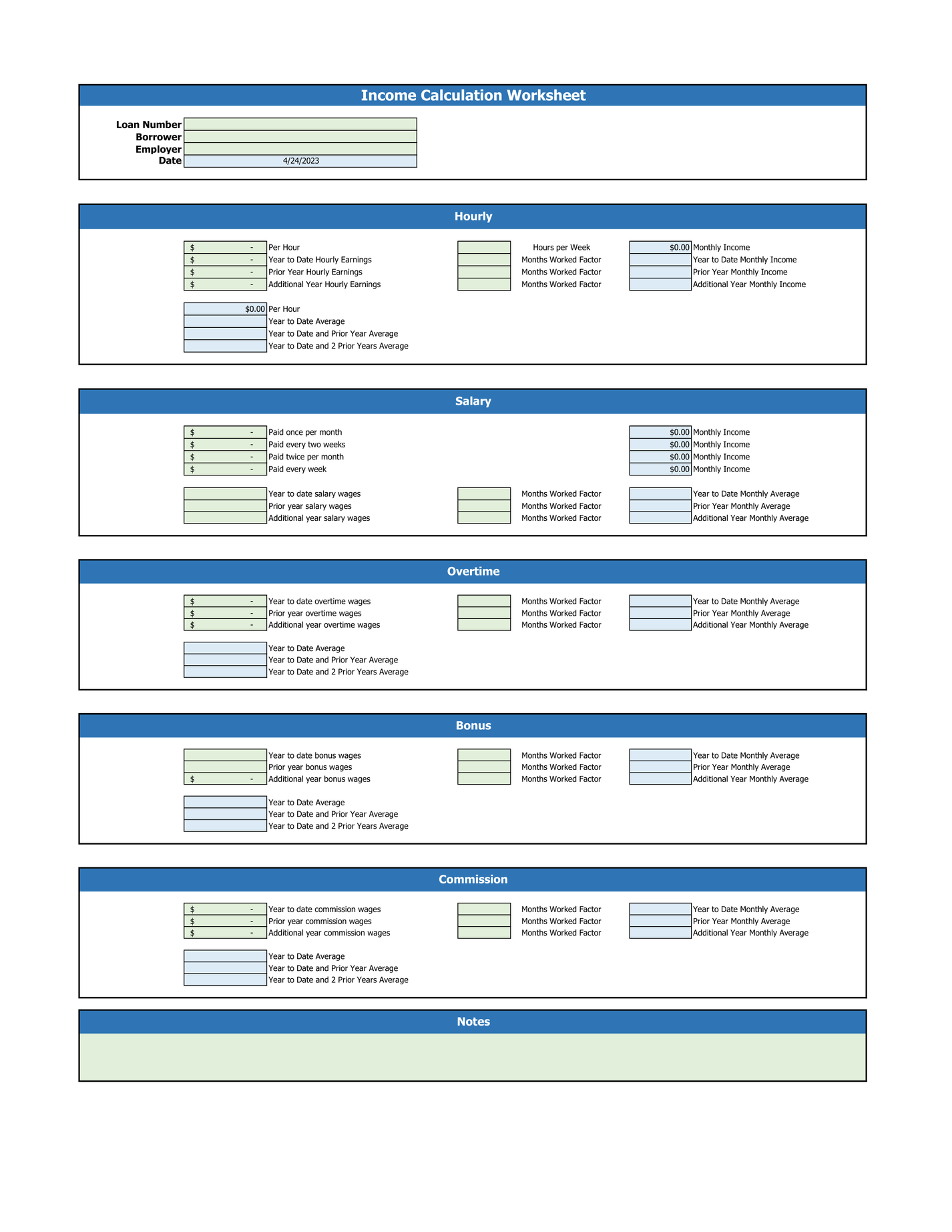

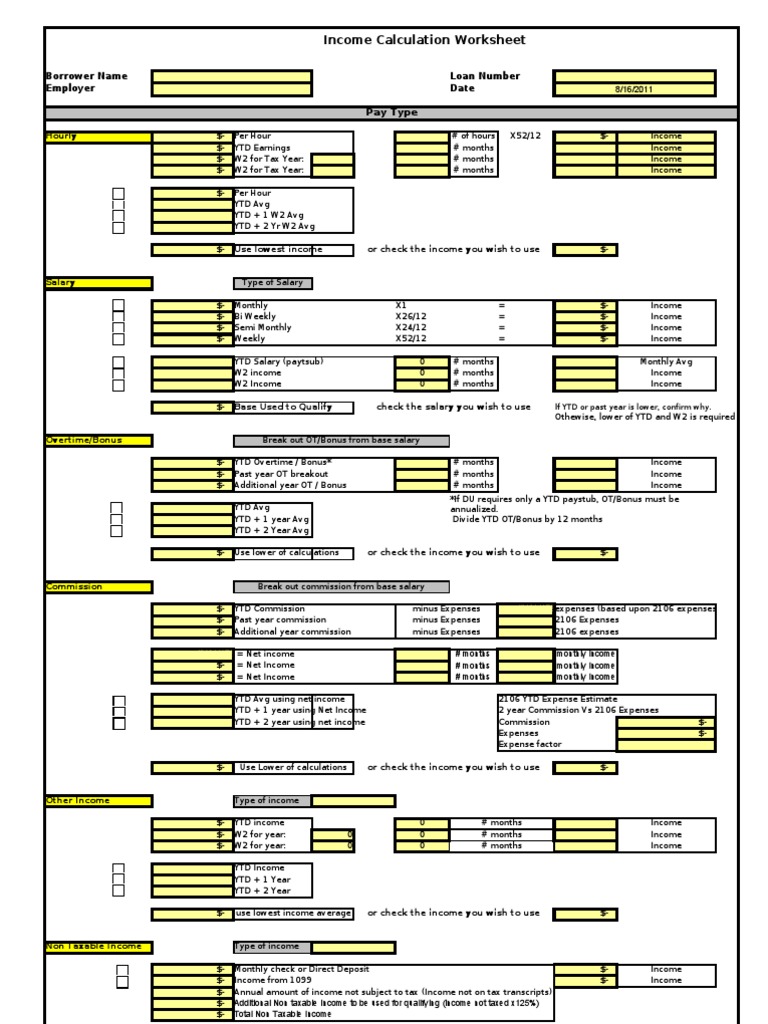

Income Calculation Worksheet Pdf

Income Calculation Worksheet Pdf - If you do not file taxes, you can complete this optional worksheet to calculate your income. You do not need to include sources of income that are not. Why to use this tool: $0.000000 ytd earnings weekly $ ytd earnings weekly $ /# of weeks weeks in a year 31: Income is what you take in every month from your job and other sources such as: Calculate monthly income what is income? Using your gross wages (before taxes) from the most recent 30 days, select the appropriate income pay cycle and calculate as directed. Sometimes monthly income can be. 7 weeks in a year 52.14 /# of weeks 52.14: Healthcare.gov asks for your current monthly income and your expected income for the year.

Calculate monthly income what is income? You do not need to include sources of income that are not. Income is what you take in every month from your job and other sources such as: Using your gross wages (before taxes) from the most recent 30 days, select the appropriate income pay cycle and calculate as directed. Healthcare.gov asks for your current monthly income and your expected income for the year. 7 weeks in a year 52.14 /# of weeks 52.14: If you do not file taxes, you can complete this optional worksheet to calculate your income. Sometimes monthly income can be. Why to use this tool: $0.000000 ytd earnings weekly $ ytd earnings weekly $ /# of weeks weeks in a year 31:

Using your gross wages (before taxes) from the most recent 30 days, select the appropriate income pay cycle and calculate as directed. Why to use this tool: Calculate monthly income what is income? Healthcare.gov asks for your current monthly income and your expected income for the year. Sometimes monthly income can be. If you do not file taxes, you can complete this optional worksheet to calculate your income. $0.000000 ytd earnings weekly $ ytd earnings weekly $ /# of weeks weeks in a year 31: Income is what you take in every month from your job and other sources such as: 7 weeks in a year 52.14 /# of weeks 52.14: You do not need to include sources of income that are not.

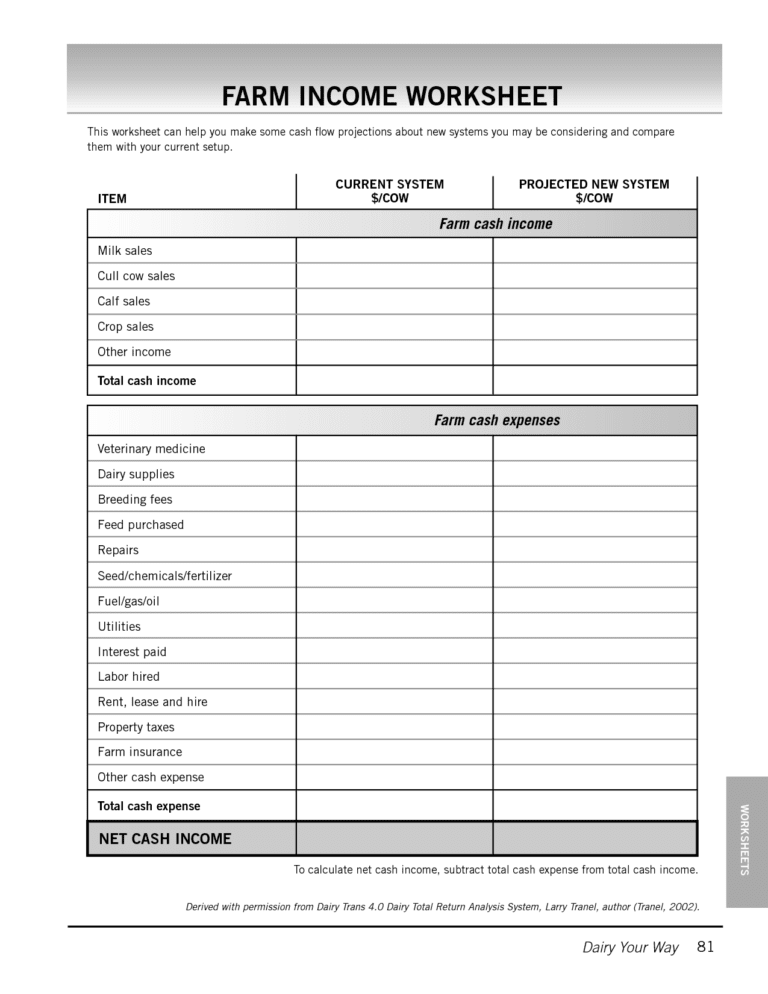

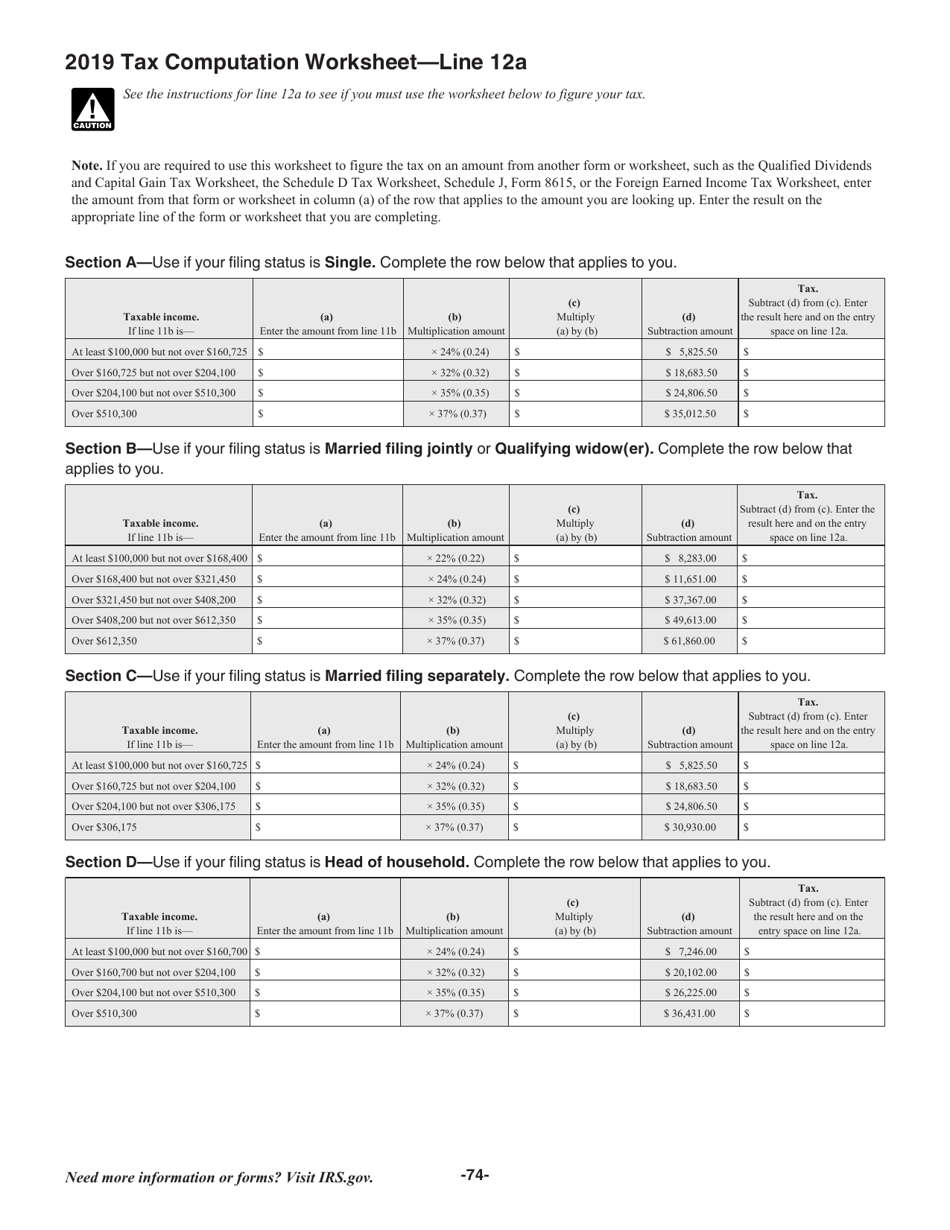

Calculation Worksheet 2024

$0.000000 ytd earnings weekly $ ytd earnings weekly $ /# of weeks weeks in a year 31: Healthcare.gov asks for your current monthly income and your expected income for the year. Sometimes monthly income can be. Income is what you take in every month from your job and other sources such as: 7 weeks in a year 52.14 /# of.

Calculation Worksheet Worksheet MLO Toolkit

You do not need to include sources of income that are not. Calculate monthly income what is income? If you do not file taxes, you can complete this optional worksheet to calculate your income. Healthcare.gov asks for your current monthly income and your expected income for the year. Sometimes monthly income can be.

Calculation Worksheet 2024

$0.000000 ytd earnings weekly $ ytd earnings weekly $ /# of weeks weeks in a year 31: Using your gross wages (before taxes) from the most recent 30 days, select the appropriate income pay cycle and calculate as directed. You do not need to include sources of income that are not. Income is what you take in every month from.

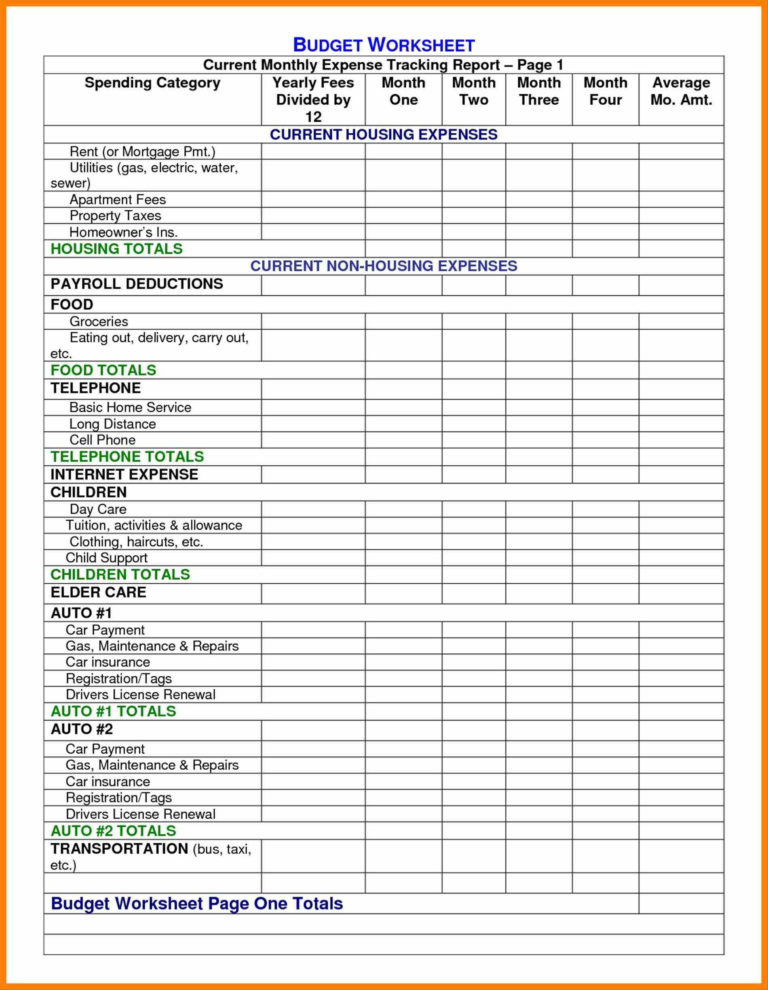

Calculation Worksheets Excel

Healthcare.gov asks for your current monthly income and your expected income for the year. Sometimes monthly income can be. Calculate monthly income what is income? If you do not file taxes, you can complete this optional worksheet to calculate your income. You do not need to include sources of income that are not.

Free and Expense Worksheet —

If you do not file taxes, you can complete this optional worksheet to calculate your income. $0.000000 ytd earnings weekly $ ytd earnings weekly $ /# of weeks weeks in a year 31: Using your gross wages (before taxes) from the most recent 30 days, select the appropriate income pay cycle and calculate as directed. 7 weeks in a year.

Calculation Worksheet 2024

If you do not file taxes, you can complete this optional worksheet to calculate your income. Using your gross wages (before taxes) from the most recent 30 days, select the appropriate income pay cycle and calculate as directed. 7 weeks in a year 52.14 /# of weeks 52.14: $0.000000 ytd earnings weekly $ ytd earnings weekly $ /# of weeks.

Tax Deduction Expense

Sometimes monthly income can be. $0.000000 ytd earnings weekly $ ytd earnings weekly $ /# of weeks weeks in a year 31: If you do not file taxes, you can complete this optional worksheet to calculate your income. Why to use this tool: Using your gross wages (before taxes) from the most recent 30 days, select the appropriate income pay.

Calculation Worksheet Pdf

Healthcare.gov asks for your current monthly income and your expected income for the year. Using your gross wages (before taxes) from the most recent 30 days, select the appropriate income pay cycle and calculate as directed. 7 weeks in a year 52.14 /# of weeks 52.14: $0.000000 ytd earnings weekly $ ytd earnings weekly $ /# of weeks weeks in.

Calculator Worksheets

$0.000000 ytd earnings weekly $ ytd earnings weekly $ /# of weeks weeks in a year 31: Using your gross wages (before taxes) from the most recent 30 days, select the appropriate income pay cycle and calculate as directed. Sometimes monthly income can be. You do not need to include sources of income that are not. If you do not.

Usda Calculation Worksheet Fill Online, Printable

Using your gross wages (before taxes) from the most recent 30 days, select the appropriate income pay cycle and calculate as directed. 7 weeks in a year 52.14 /# of weeks 52.14: You do not need to include sources of income that are not. Healthcare.gov asks for your current monthly income and your expected income for the year. If you.

You Do Not Need To Include Sources Of Income That Are Not.

$0.000000 ytd earnings weekly $ ytd earnings weekly $ /# of weeks weeks in a year 31: Sometimes monthly income can be. Why to use this tool: Calculate monthly income what is income?

Income Is What You Take In Every Month From Your Job And Other Sources Such As:

If you do not file taxes, you can complete this optional worksheet to calculate your income. Healthcare.gov asks for your current monthly income and your expected income for the year. 7 weeks in a year 52.14 /# of weeks 52.14: Using your gross wages (before taxes) from the most recent 30 days, select the appropriate income pay cycle and calculate as directed.