Capital Lease Balance Sheet

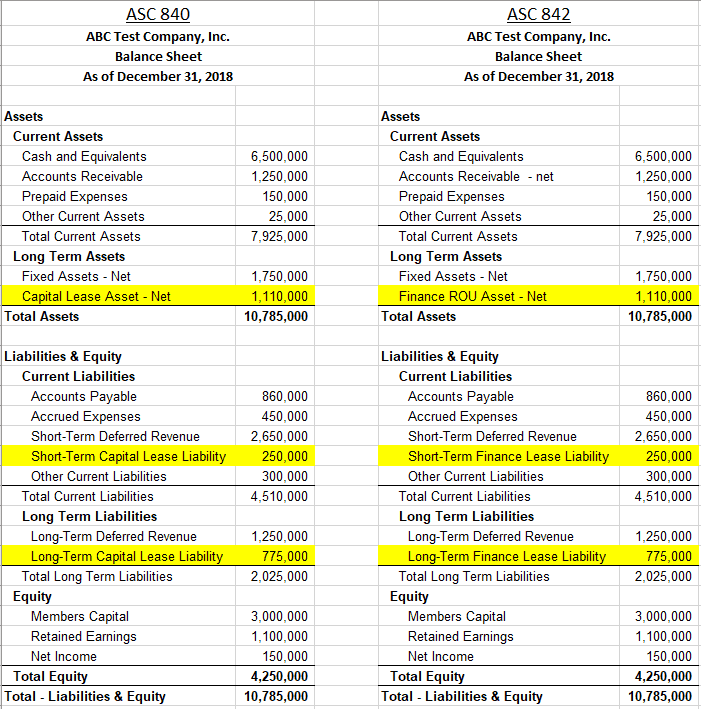

Capital Lease Balance Sheet - Asc 840 capital leases and asc 842 finance leases are substantially the same. Asset is recorded on the gross assets. This means that the lessee is assuming the risks and. A lessee must capitalize leased assets if the lease. Web the capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the balance sheet. Web a finance lease (previously called a capital lease in asc 840) is a lease that’s effectively a purchase arrangement. A liability for lease is also recorded on the liability side. Web a capital lease accounting has broadly 3 effects on the balance sheet. Web how to account for a capital lease. A capital lease is a lease in which the lessee records the underlying asset as though it owns the asset.

This means that the lessee is assuming the risks and. A lessee must capitalize leased assets if the lease. Asc 840 capital leases and asc 842 finance leases are substantially the same. A liability for lease is also recorded on the liability side. Web a capital lease accounting has broadly 3 effects on the balance sheet. Web a finance lease (previously called a capital lease in asc 840) is a lease that’s effectively a purchase arrangement. Asset is recorded on the gross assets. Web how to account for a capital lease. Web the capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the balance sheet. A capital lease is a lease in which the lessee records the underlying asset as though it owns the asset.

Web the capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the balance sheet. A liability for lease is also recorded on the liability side. Asset is recorded on the gross assets. Web how to account for a capital lease. This means that the lessee is assuming the risks and. Asc 840 capital leases and asc 842 finance leases are substantially the same. A capital lease is a lease in which the lessee records the underlying asset as though it owns the asset. Web a finance lease (previously called a capital lease in asc 840) is a lease that’s effectively a purchase arrangement. A lessee must capitalize leased assets if the lease. Web a capital lease accounting has broadly 3 effects on the balance sheet.

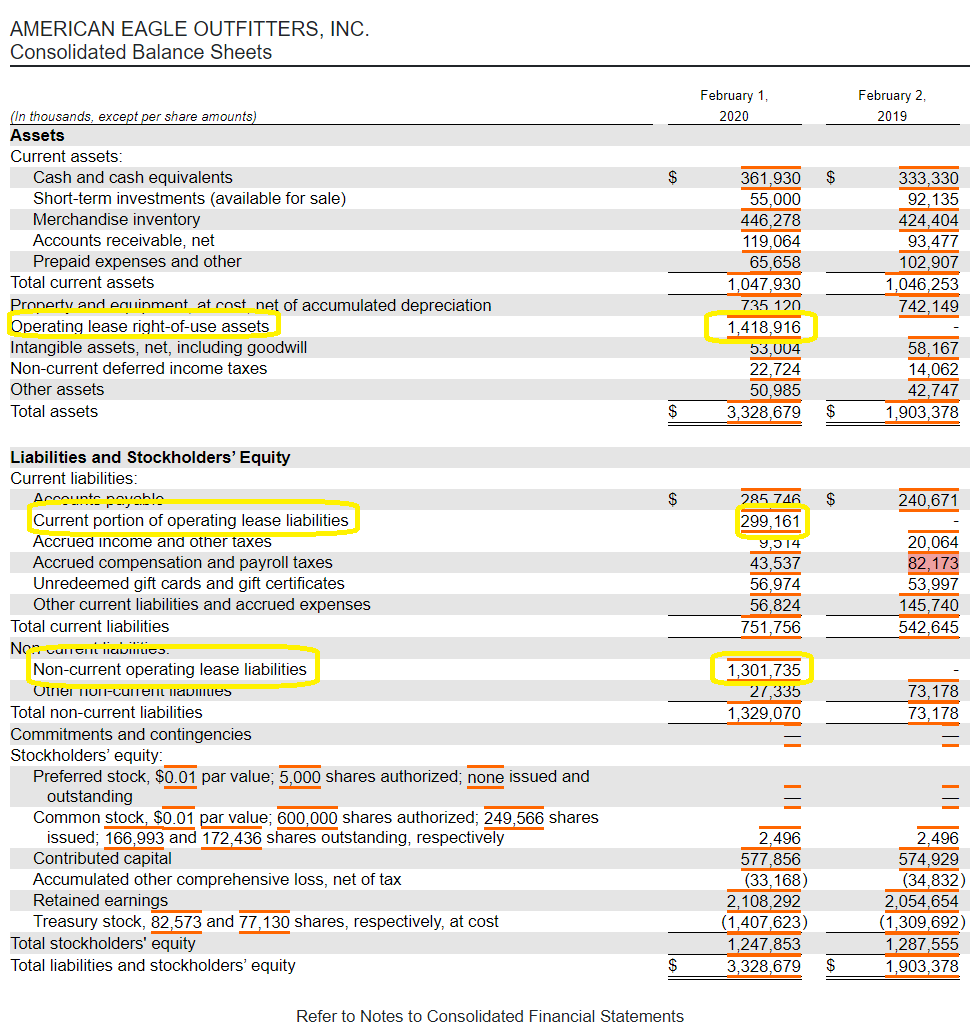

ASC 842 Lease Accounting Balance Sheet Examples Visual Lease

Web the capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the balance sheet. Web how to account for a capital lease. A lessee must capitalize leased assets if the lease. Web a capital lease accounting has broadly 3 effects on the balance sheet. Asc 840 capital leases and asc 842 finance.

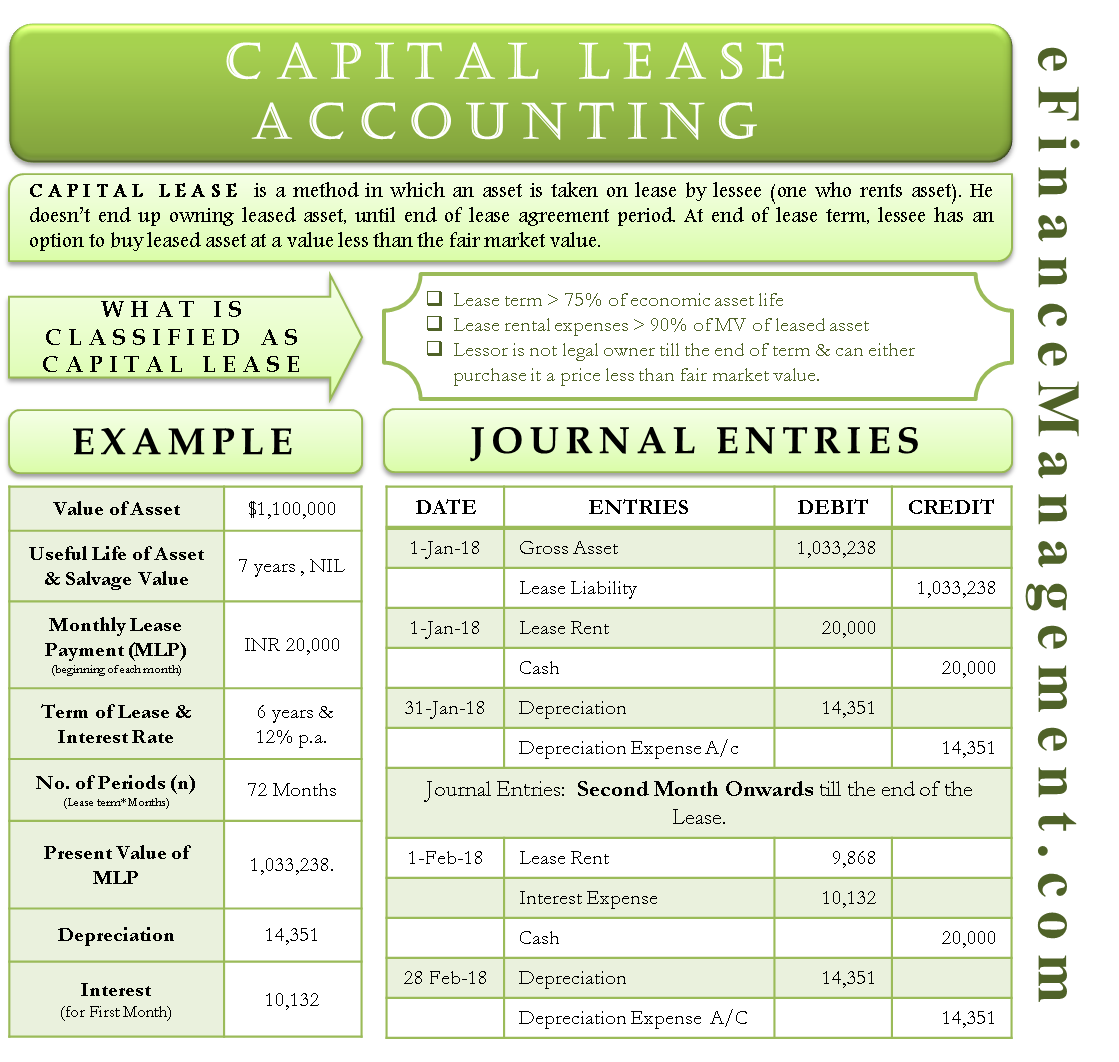

Capital Lease Accounting With Example and Journal Entries

A liability for lease is also recorded on the liability side. A lessee must capitalize leased assets if the lease. Web the capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the balance sheet. Asc 840 capital leases and asc 842 finance leases are substantially the same. Web how to account for.

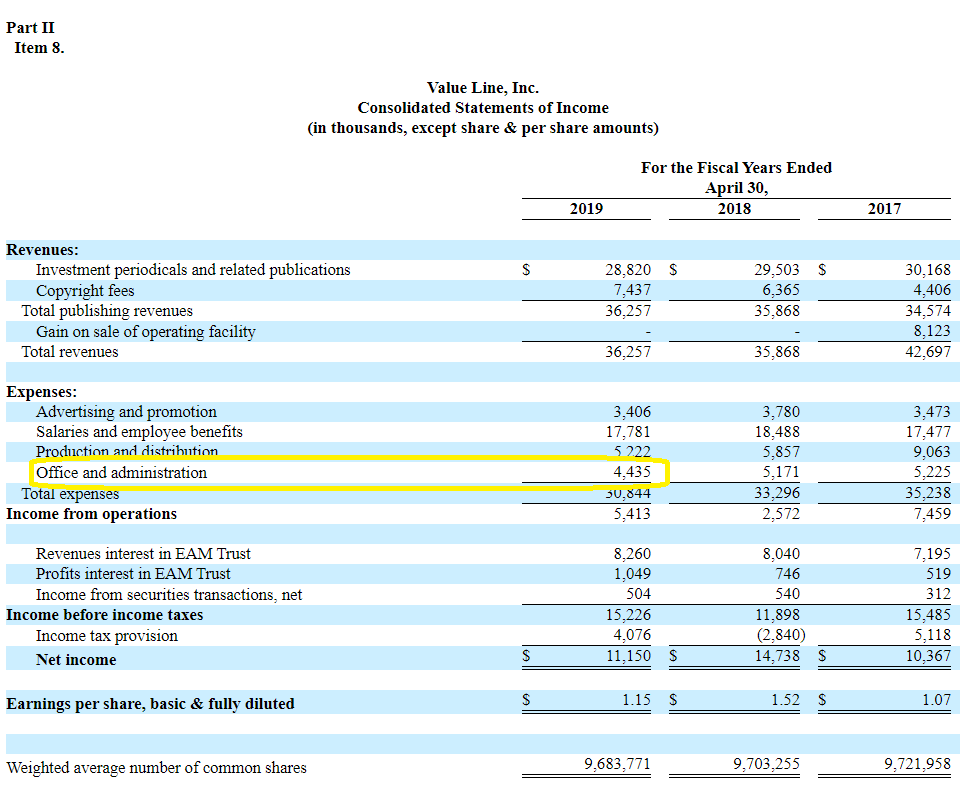

Balance Sheet( in thousands)(1) Includes capital lease obligations of

Asc 840 capital leases and asc 842 finance leases are substantially the same. Web a capital lease accounting has broadly 3 effects on the balance sheet. A capital lease is a lease in which the lessee records the underlying asset as though it owns the asset. A lessee must capitalize leased assets if the lease. A liability for lease is.

How To Account For Finance Lease By Lessee businesser

A liability for lease is also recorded on the liability side. Web how to account for a capital lease. Web a capital lease accounting has broadly 3 effects on the balance sheet. Asset is recorded on the gross assets. Web the capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the balance.

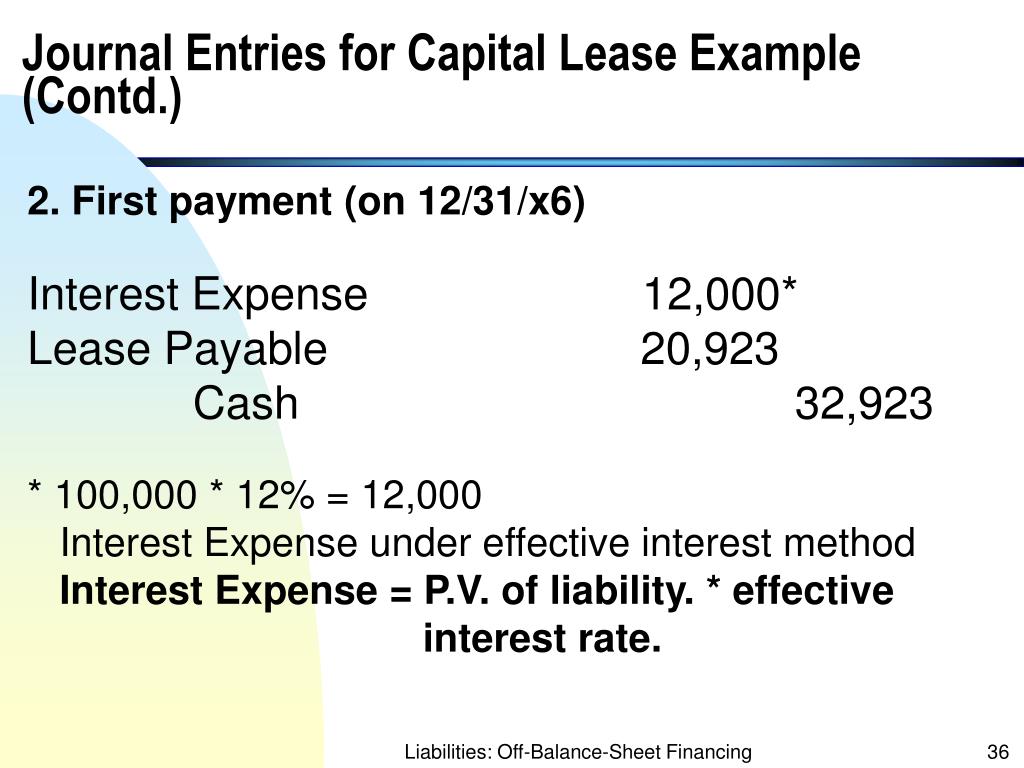

PPT Liabilities OffBalanceSheet Financing PowerPoint Presentation

A lessee must capitalize leased assets if the lease. Web the capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the balance sheet. A liability for lease is also recorded on the liability side. A capital lease is a lease in which the lessee records the underlying asset as though it owns.

Operating Leases Now in the Balance Sheet GAAP Accounting Made Simple

A lessee must capitalize leased assets if the lease. Asc 840 capital leases and asc 842 finance leases are substantially the same. This means that the lessee is assuming the risks and. A capital lease is a lease in which the lessee records the underlying asset as though it owns the asset. Web the capitalized lease method is an accounting.

Us Gaap Illustrative Financial Statements 2018 Inventory On Balance

A lessee must capitalize leased assets if the lease. A liability for lease is also recorded on the liability side. Web how to account for a capital lease. Web the capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the balance sheet. Asset is recorded on the gross assets.

PPT Accounting for a Capital Lease PowerPoint Presentation, free

This means that the lessee is assuming the risks and. A lessee must capitalize leased assets if the lease. A liability for lease is also recorded on the liability side. A capital lease is a lease in which the lessee records the underlying asset as though it owns the asset. Web a capital lease accounting has broadly 3 effects on.

Capital Lease vs. Operating Lease U.S. GAAP Lease Accounting

Asc 840 capital leases and asc 842 finance leases are substantially the same. Web how to account for a capital lease. Web the capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the balance sheet. A liability for lease is also recorded on the liability side. A lessee must capitalize leased assets.

PPT Liabilities OffBalanceSheet Financing PowerPoint Presentation

Web a capital lease accounting has broadly 3 effects on the balance sheet. Web a finance lease (previously called a capital lease in asc 840) is a lease that’s effectively a purchase arrangement. A liability for lease is also recorded on the liability side. Web how to account for a capital lease. Asset is recorded on the gross assets.

Web A Finance Lease (Previously Called A Capital Lease In Asc 840) Is A Lease That’s Effectively A Purchase Arrangement.

Asc 840 capital leases and asc 842 finance leases are substantially the same. Web a capital lease accounting has broadly 3 effects on the balance sheet. A liability for lease is also recorded on the liability side. A capital lease is a lease in which the lessee records the underlying asset as though it owns the asset.

Web The Capitalized Lease Method Is An Accounting Approach That Posts A Company's Lease Obligation As An Asset On The Balance Sheet.

This means that the lessee is assuming the risks and. A lessee must capitalize leased assets if the lease. Asset is recorded on the gross assets. Web how to account for a capital lease.