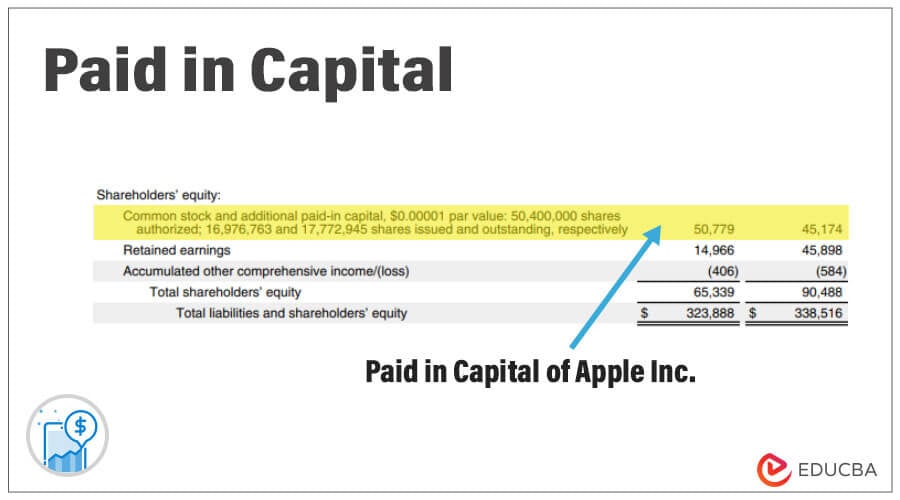

Additional Paid In Capital Balance Sheet

Additional Paid In Capital Balance Sheet - Web here the par value would be = (10,000 * 1) = $10,000. The par value of the shares is subtracted from the issuance price at which the shares were sold. The excess of the sale.

The par value of the shares is subtracted from the issuance price at which the shares were sold. The excess of the sale. Web here the par value would be = (10,000 * 1) = $10,000.

Web here the par value would be = (10,000 * 1) = $10,000. The excess of the sale. The par value of the shares is subtracted from the issuance price at which the shares were sold.

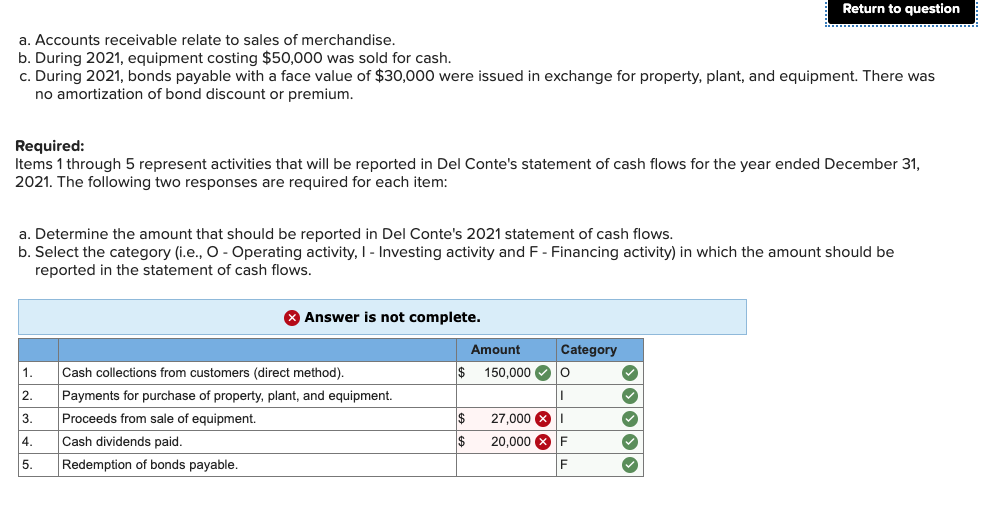

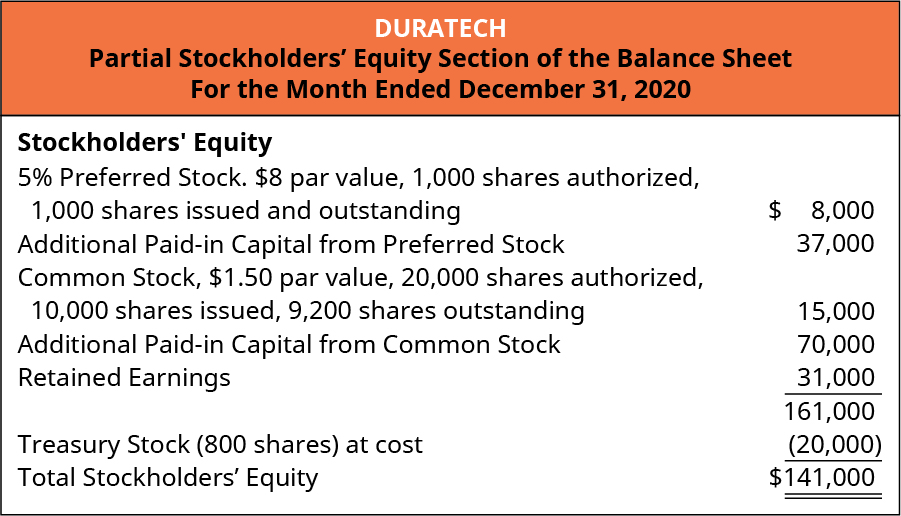

Solved Following are selected balance sheet accounts of Del

The par value of the shares is subtracted from the issuance price at which the shares were sold. The excess of the sale. Web here the par value would be = (10,000 * 1) = $10,000.

29+ mortgage initial disclosures RaajEleonore

The par value of the shares is subtracted from the issuance price at which the shares were sold. The excess of the sale. Web here the par value would be = (10,000 * 1) = $10,000.

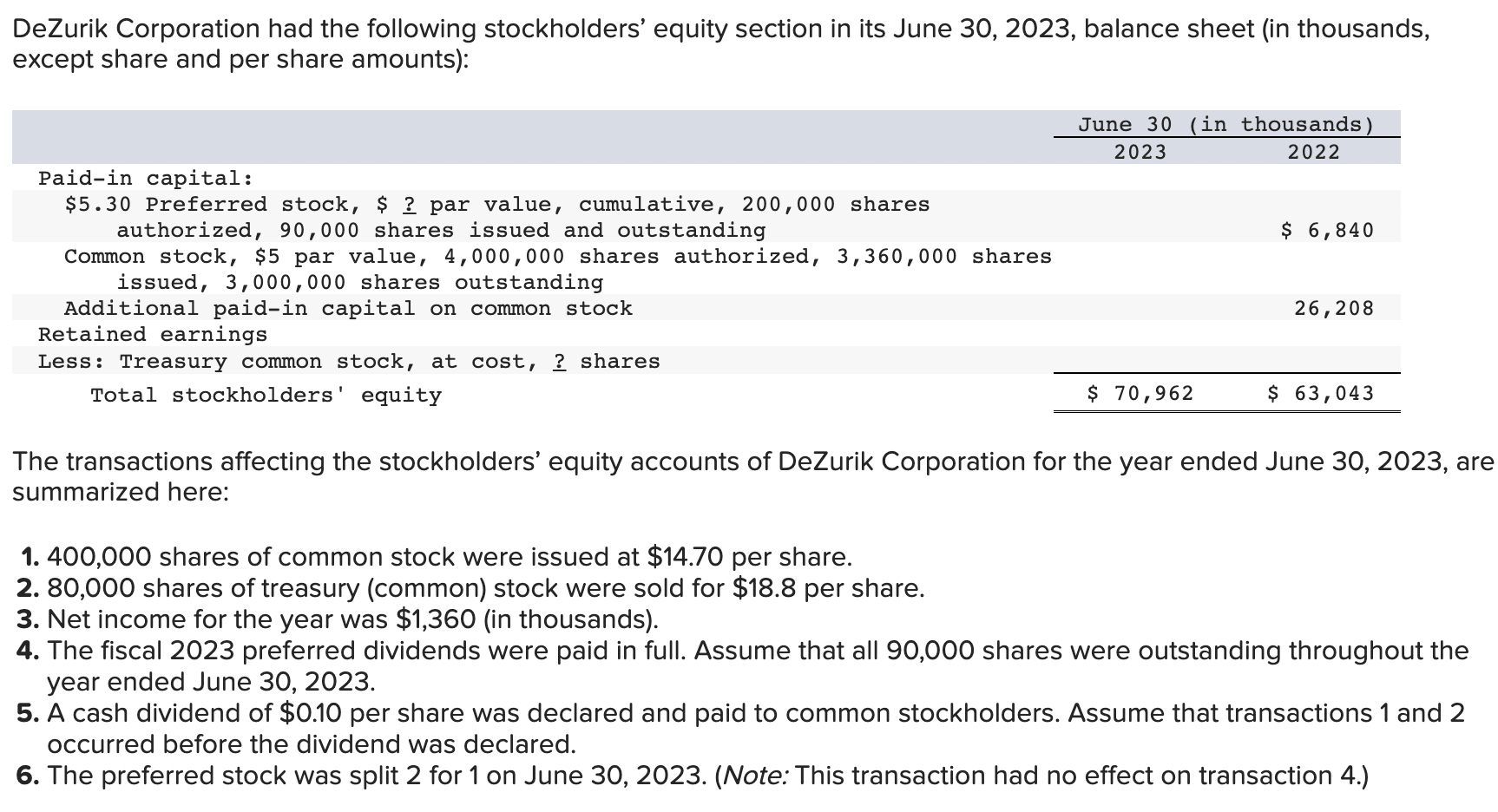

Solved DeZurik Corporation had the following stockholders’

Web here the par value would be = (10,000 * 1) = $10,000. The par value of the shares is subtracted from the issuance price at which the shares were sold. The excess of the sale.

Beautiful Capital Injection Balance Sheet Pepsico Financial Analysis

Web here the par value would be = (10,000 * 1) = $10,000. The excess of the sale. The par value of the shares is subtracted from the issuance price at which the shares were sold.

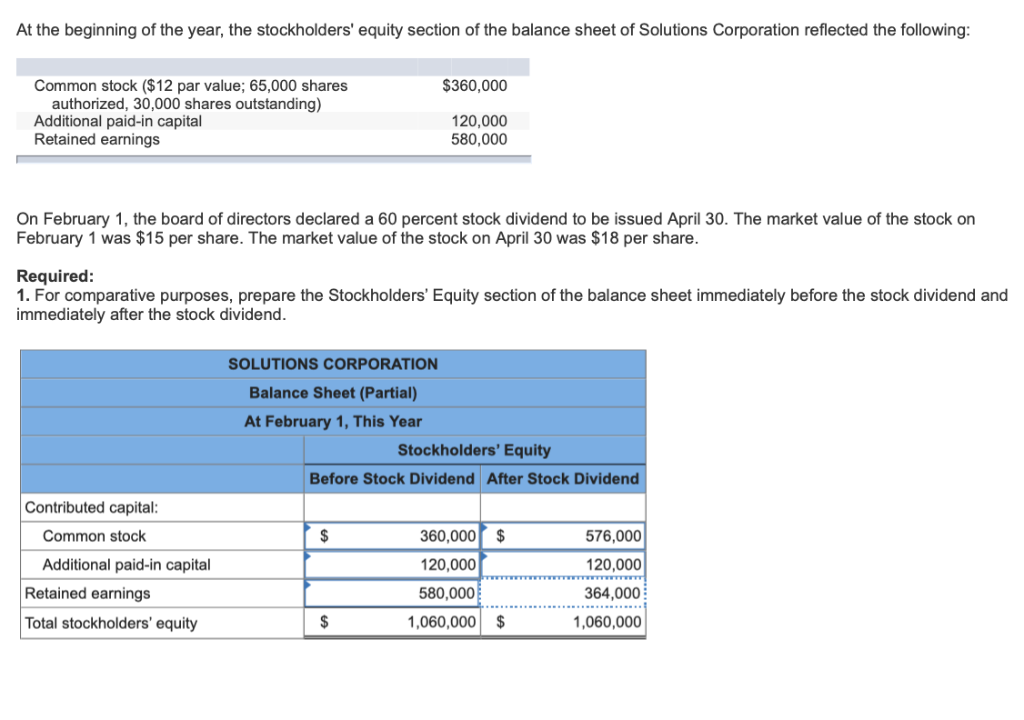

Solved At the beginning of the year, the stockholders'

The excess of the sale. Web here the par value would be = (10,000 * 1) = $10,000. The par value of the shares is subtracted from the issuance price at which the shares were sold.

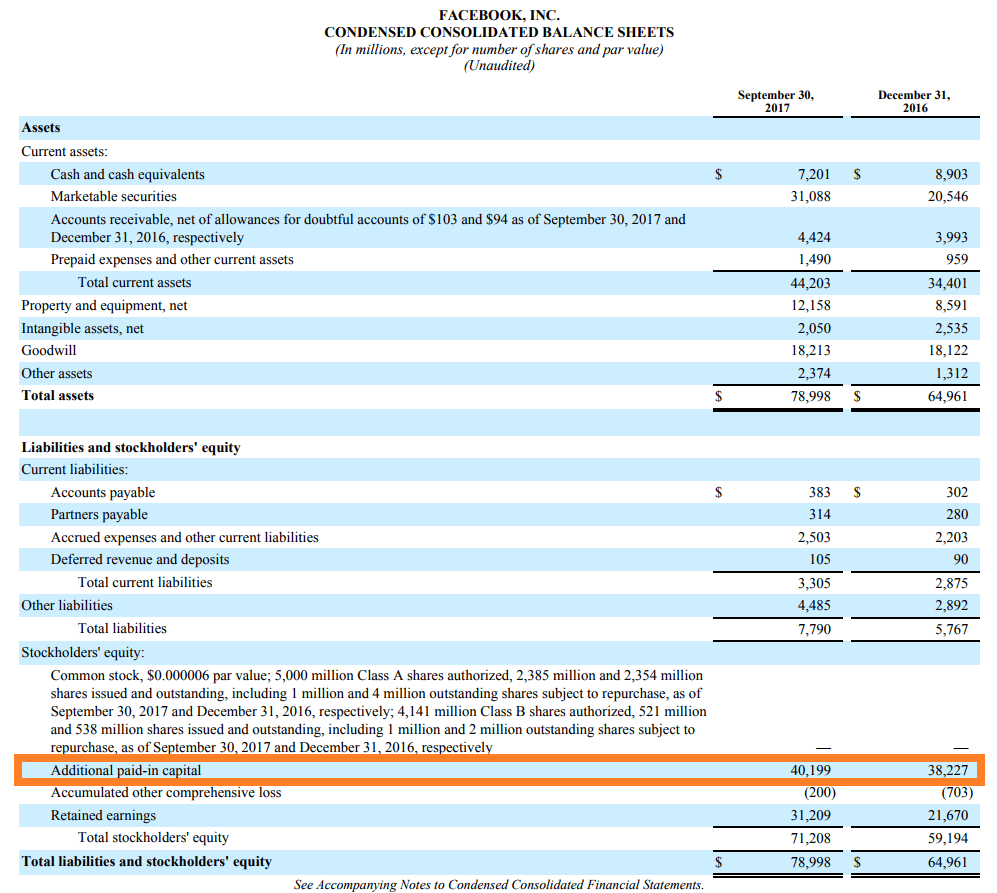

Additional PaidIn Capital (APIC) Formula + Calculation

The par value of the shares is subtracted from the issuance price at which the shares were sold. The excess of the sale. Web here the par value would be = (10,000 * 1) = $10,000.

Additional Paid In Capital Definition, Calculation & Examples

Web here the par value would be = (10,000 * 1) = $10,000. The par value of the shares is subtracted from the issuance price at which the shares were sold. The excess of the sale.

Write a short note on Capital Structure and its components. HSC

Web here the par value would be = (10,000 * 1) = $10,000. The par value of the shares is subtracted from the issuance price at which the shares were sold. The excess of the sale.

Does APIC have a debit or credit balance? Leia aqui Does APIC have a

The par value of the shares is subtracted from the issuance price at which the shares were sold. Web here the par value would be = (10,000 * 1) = $10,000. The excess of the sale.

The Par Value Of The Shares Is Subtracted From The Issuance Price At Which The Shares Were Sold.

Web here the par value would be = (10,000 * 1) = $10,000. The excess of the sale.