A Common Size Balance Sheet Helps Financial Managers Determine

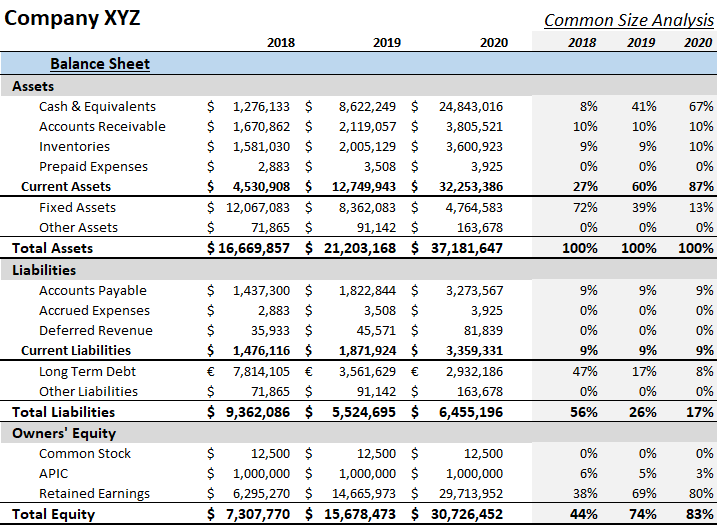

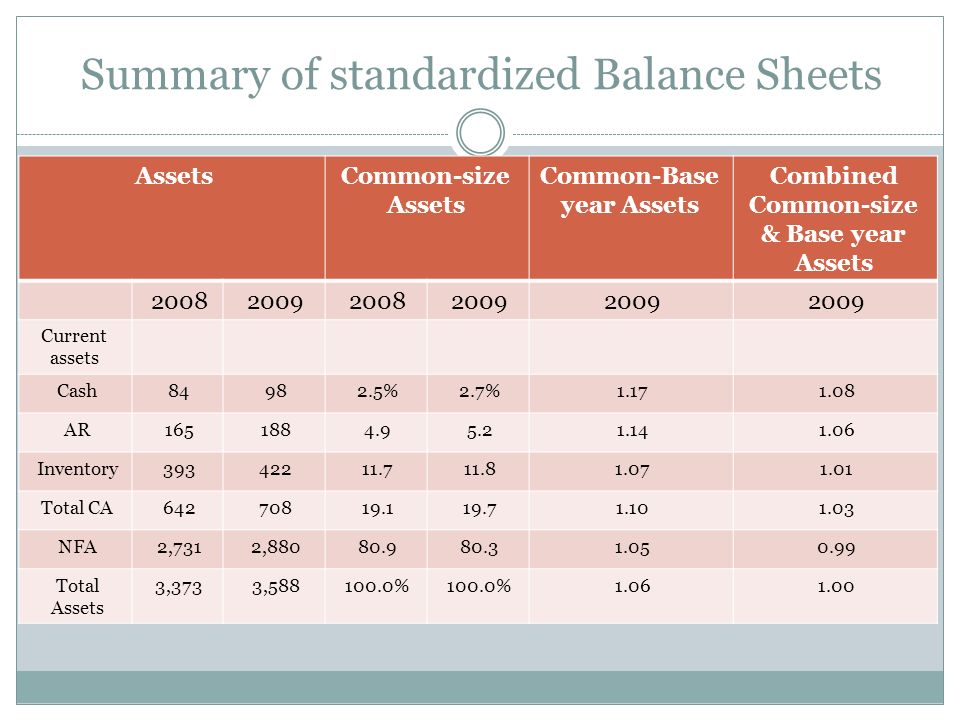

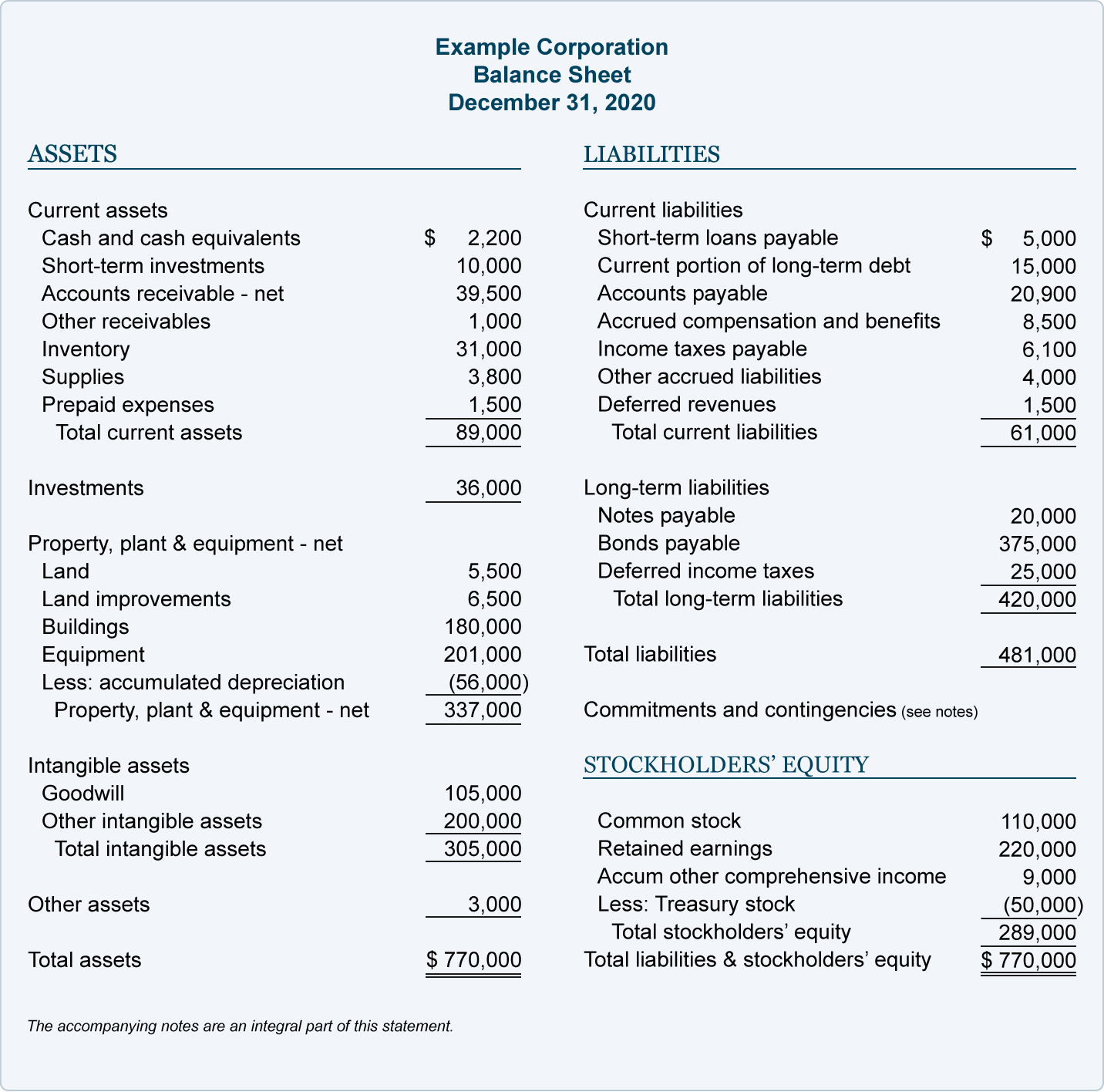

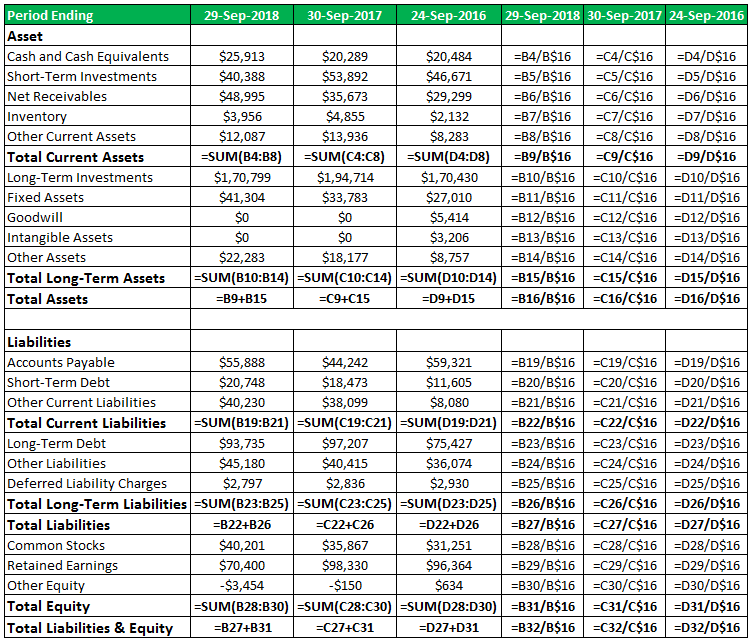

A Common Size Balance Sheet Helps Financial Managers Determine - Web the balance sheet common size analysis mostly uses the total assets value as the base value. Expressing each item on the balance sheet as a percentage of total. Analysts are generally most interested in ratios that measure liquidity. Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts.

A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Analysts are generally most interested in ratios that measure liquidity. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. Expressing each item on the balance sheet as a percentage of total. Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. Web the balance sheet common size analysis mostly uses the total assets value as the base value.

Expressing each item on the balance sheet as a percentage of total. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. Analysts are generally most interested in ratios that measure liquidity. Web the balance sheet common size analysis mostly uses the total assets value as the base value. Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to.

What is a CommonSize Balance Sheet? 365 Financial Analyst

A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Analysts are generally most interested in ratios that measure liquidity. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. Expressing each item.

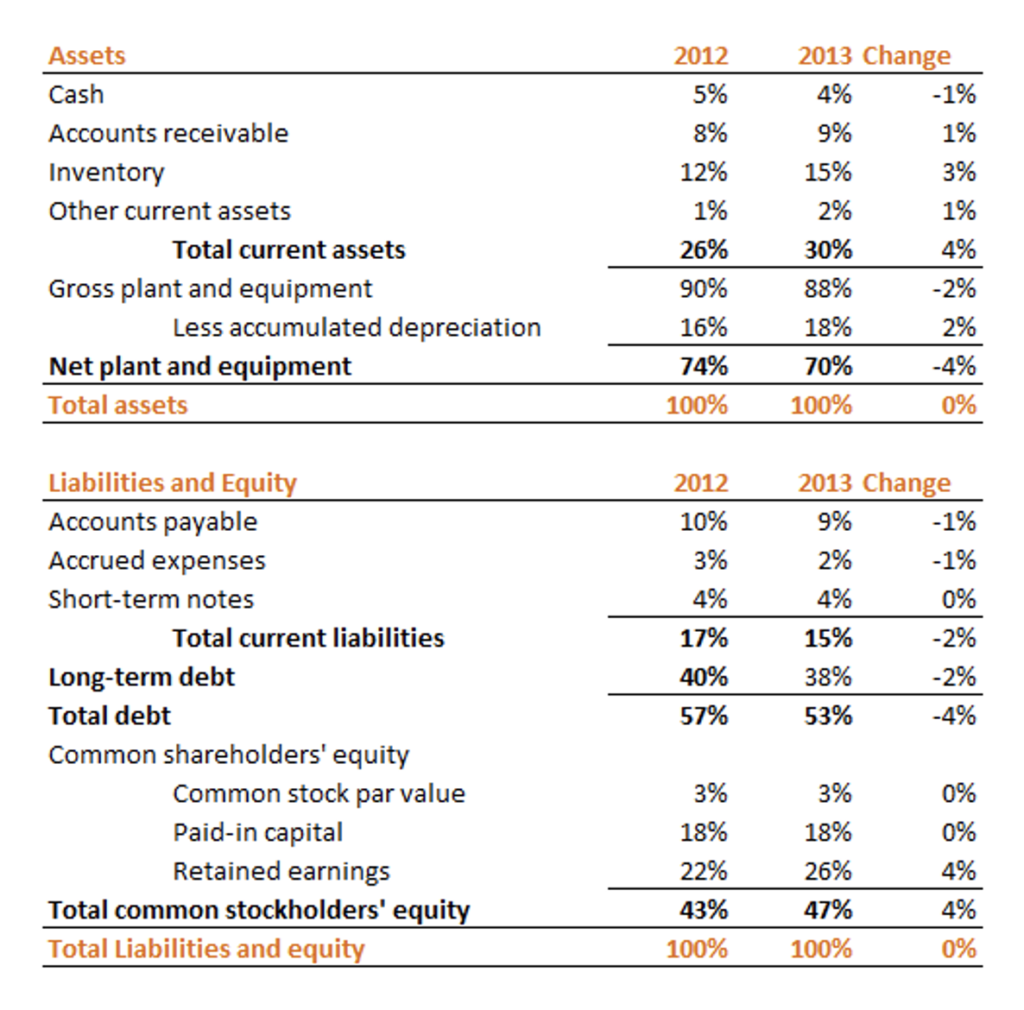

CommonSize Analysis of Financial Statements Accounting for Managers

Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web a common size balance sheet is a balance sheet that displays both the numeric value.

How to Figure the Common Size BalanceSheet Percentages Online Accounting

Expressing each item on the balance sheet as a percentage of total. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent.

Understanding Your Balance Sheet Financial Accounting Protea

Web the balance sheet common size analysis mostly uses the total assets value as the base value. Analysts are generally most interested in ratios that measure liquidity. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web a common size balance sheet is a balance sheet that displays both.

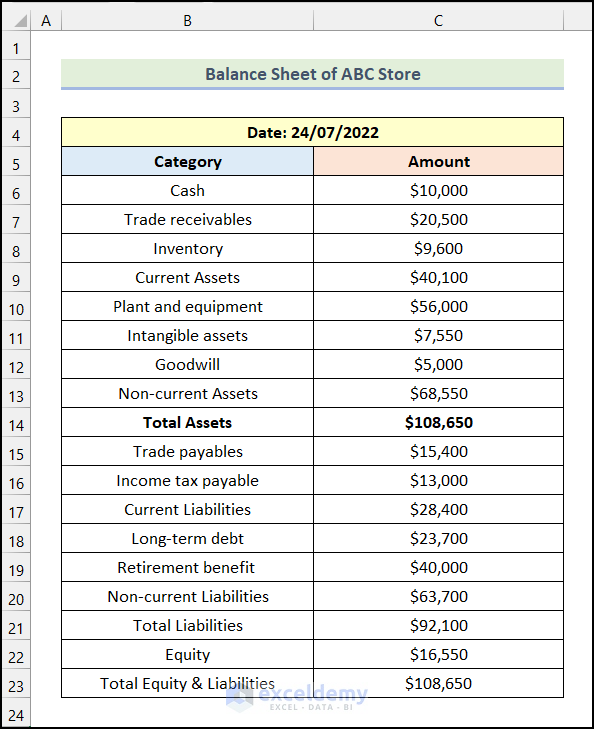

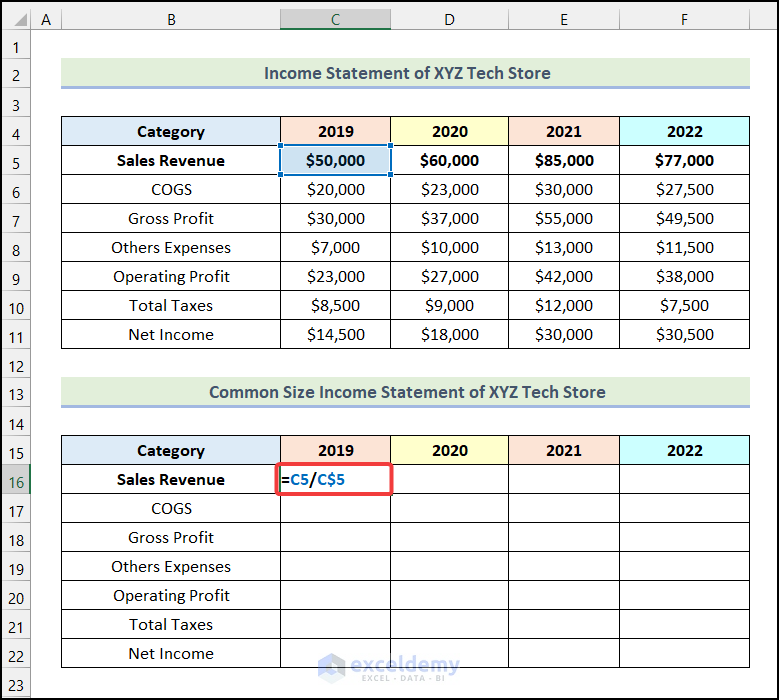

How to Create Common Size Balance Sheet in Excel (3 Simple Steps

Analysts are generally most interested in ratios that measure liquidity. Expressing each item on the balance sheet as a percentage of total. Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. A financial manager or investor can use the common size analysis to see how.

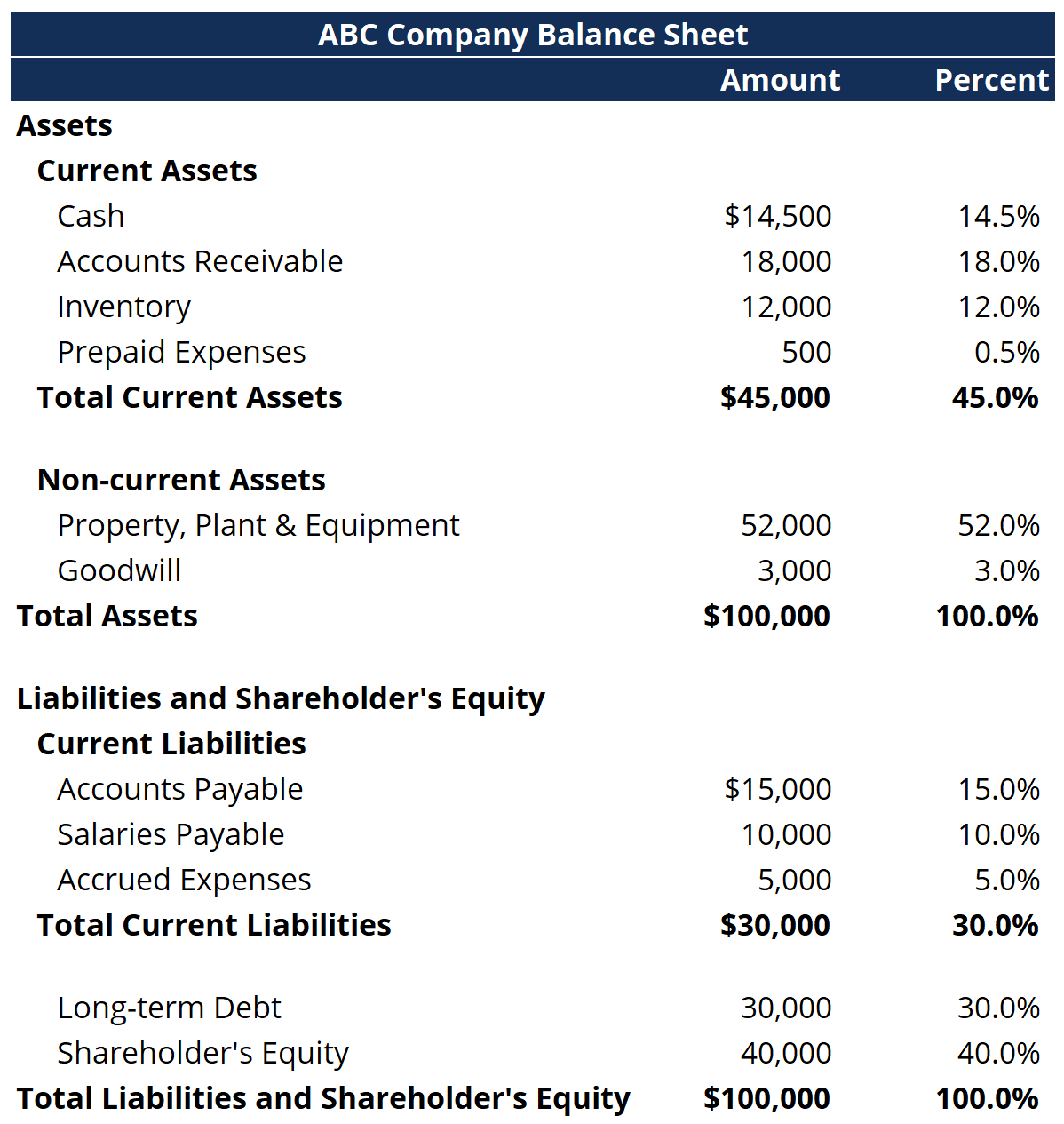

Common Size Balance Sheet Analysis (Format, Examples)

A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web the balance sheet common size analysis mostly uses the total assets value as the base value. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total.

Common Size Balance Sheet Finance Train

Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. Expressing each item on the balance sheet as a percentage of total. Analysts are generally most interested in ratios that measure liquidity. Web the balance sheet common size analysis mostly uses the total assets value as.

How to Create Common Size Balance Sheet in Excel ExcelDemy

Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. Web the balance sheet common size analysis mostly uses.

Common Size Analysis Overview, Examples, How to Perform

Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. Web the balance sheet common size analysis mostly uses the total assets value as the base value. Expressing each item on the balance sheet as a percentage of total. A financial manager or investor can use.

Common Size Balance Sheet Definition, Formula, Example

Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. Expressing each item on the balance sheet as a percentage of total. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web.

A Financial Manager Or Investor Can Use The Common Size Analysis To See How A Firm’s Capital Structure Compares To.

Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. Web the balance sheet common size analysis mostly uses the total assets value as the base value. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. Analysts are generally most interested in ratios that measure liquidity.

:max_bytes(150000):strip_icc()/Commonsizebalancesheet_final-63f083ed70e64e9da232560ae41429ce.png)