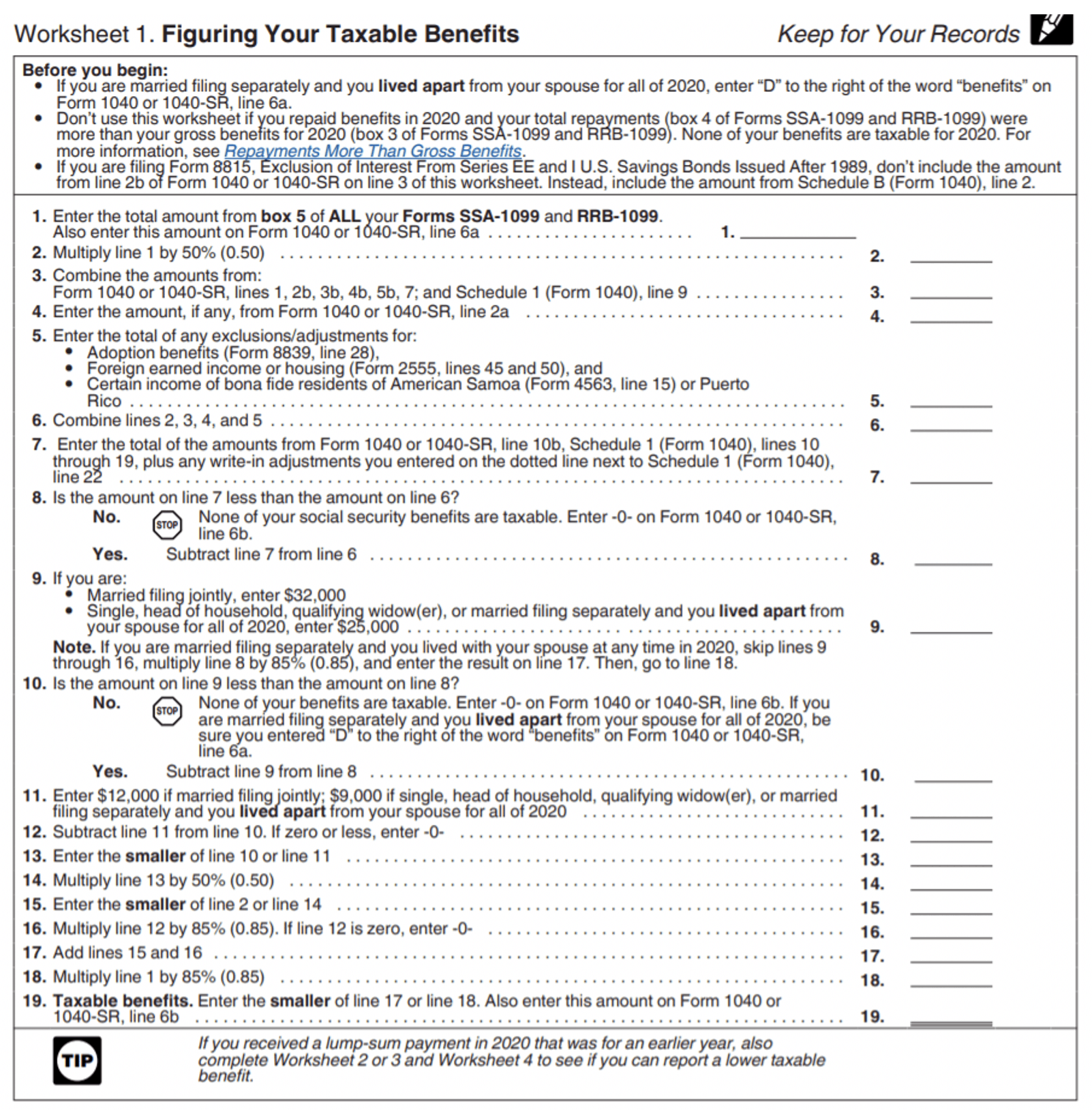

2023 Taxable Social Security Worksheet

2023 Taxable Social Security Worksheet - Fill in lines a through e. The taxable social security base amount ($32,000) for joint filers. We developed this worksheet for you to see if your benefits may be taxable for 2023. • the first option allows the. Worksheet to determine if benefits. The worksheet provided can be used to determine the exact amount. Do not use the worksheet below if any. Social security goes on 1040 line 6a and the taxable amount on 6b. Use this worksheet to determine if your social security and/or ssi benefits are taxable for the year 2023. Find the current revision, recent.

The worksheet provided can be used to determine the exact amount. None of their social security benefits are taxable. Fill in lines a through e. Use this worksheet to determine if your social security and/or ssi benefits are taxable for the year 2023. Worksheet to determine if benefits. The taxable portion can range from 50 to 85 percent of your benefits. Social security goes on 1040 line 6a and the taxable amount on 6b. • the first option allows the. Do not use the worksheet below if any. Find the current revision, recent.

Social security goes on 1040 line 6a and the taxable amount on 6b. None of their social security benefits are taxable. The worksheet provided can be used to determine the exact amount. Use this worksheet to determine if your social security and/or ssi benefits are taxable for the year 2023. Fill in lines a through e. We developed this worksheet for you to see if your benefits may be taxable for 2023. Do not use the worksheet below if any. • the first option allows the. You don't need to figure or include the worksheet. Worksheet to determine if benefits.

Pub 915 Worksheet 2023 Publication 915 2023 Worksheet 1

Use this worksheet to determine if your social security and/or ssi benefits are taxable for the year 2023. The worksheet provided can be used to determine the exact amount. Find the current revision, recent. We developed this worksheet for you to see if your benefits may be taxable for 2023. Worksheet to determine if benefits.

Taxable Social Security Worksheet 2024 Pdf Daria Xaviera

Use this worksheet to determine if your social security and/or ssi benefits are taxable for the year 2023. We developed this worksheet for you to see if your benefits may be taxable for 2023. Social security goes on 1040 line 6a and the taxable amount on 6b. The worksheet provided can be used to determine the exact amount. The taxable.

Social Security Benefits Worksheet

The worksheet provided can be used to determine the exact amount. The taxable social security base amount ($32,000) for joint filers. None of their social security benefits are taxable. Do not use the worksheet below if any. The taxable portion can range from 50 to 85 percent of your benefits.

Taxable Social Security Worksheet 2024

Worksheet to determine if benefits. None of their social security benefits are taxable. Fill in lines a through e. The taxable social security base amount ($32,000) for joint filers. We developed this worksheet for you to see if your benefits may be taxable for 2023.

Ss Worksheet 2023 Taxable Social Security Worksheets

Do not use the worksheet below if any. None of their social security benefits are taxable. You don't need to figure or include the worksheet. Social security goes on 1040 line 6a and the taxable amount on 6b. Find the current revision, recent.

Worksheet Taxable Social Security Benefits Taxable Social Se

Worksheet to determine if benefits. The taxable portion can range from 50 to 85 percent of your benefits. The taxable social security base amount ($32,000) for joint filers. You don't need to figure or include the worksheet. • the first option allows the.

How To Fill Out Taxable Social Security Worksheet 2023 1040

The taxable social security base amount ($32,000) for joint filers. You don't need to figure or include the worksheet. None of their social security benefits are taxable. Social security goes on 1040 line 6a and the taxable amount on 6b. We developed this worksheet for you to see if your benefits may be taxable for 2023.

1040 Social Security Worksheet 2023 Ssi Worksheet Printable

None of their social security benefits are taxable. The worksheet provided can be used to determine the exact amount. You don't need to figure or include the worksheet. Find the current revision, recent. Do not use the worksheet below if any.

2023 Taxable Social Security Worksheet Social Security Retir

Fill in lines a through e. Social security goes on 1040 line 6a and the taxable amount on 6b. • the first option allows the. The taxable portion can range from 50 to 85 percent of your benefits. The taxable social security base amount ($32,000) for joint filers.

Social Security Benefits Worksheet (2023) PDFliner Worksheets Library

Worksheet to determine if benefits. • the first option allows the. Do not use the worksheet below if any. The worksheet provided can be used to determine the exact amount. We developed this worksheet for you to see if your benefits may be taxable for 2023.

The Taxable Social Security Base Amount ($32,000) For Joint Filers.

We developed this worksheet for you to see if your benefits may be taxable for 2023. Do not use the worksheet below if any. None of their social security benefits are taxable. Use this worksheet to determine if your social security and/or ssi benefits are taxable for the year 2023.

Social Security Goes On 1040 Line 6A And The Taxable Amount On 6B.

The taxable portion can range from 50 to 85 percent of your benefits. Fill in lines a through e. You don't need to figure or include the worksheet. Find the current revision, recent.

The Worksheet Provided Can Be Used To Determine The Exact Amount.

• the first option allows the. Worksheet to determine if benefits.